Sprintax

About Us & Mission

We’re on a mission to make the complex simple, creating space for our customers to live life. Whether you’re preparing to start a new job in the US, or looking to file your first US nonresident tax return, Sprintax is here to support you every step of the way. Sprintax Calculus is the engine behind our multi-jurisdiction, tax compliance software which simplifies payroll processing for nonresident employers.

$1,184

Average federal refund

1m+

Federal tax returns filed

650

School & corporate partners

203

Nationalities assisted

Sprintax for You

Returns

File your US nonresident tax return (forms 1040-NR, 1040X, 8843, claim a FICA tax refund)

Sprintax for Business

Calculus

All in one tax withholding and compliance solution for corporations with international employees and vendors.

Dividends Partners

Reclaim cross-border Dividend Withholding Tax. All in one solution for organizations earning share income internationally.

Why Sprintax

Compliance

Rest assured that tax compliance is our highest priority. We consistently review changes in multi-jurisdiction legislative requirements, keeping you informed on amendments relating to residency and treaty benefits for your nonresident population.

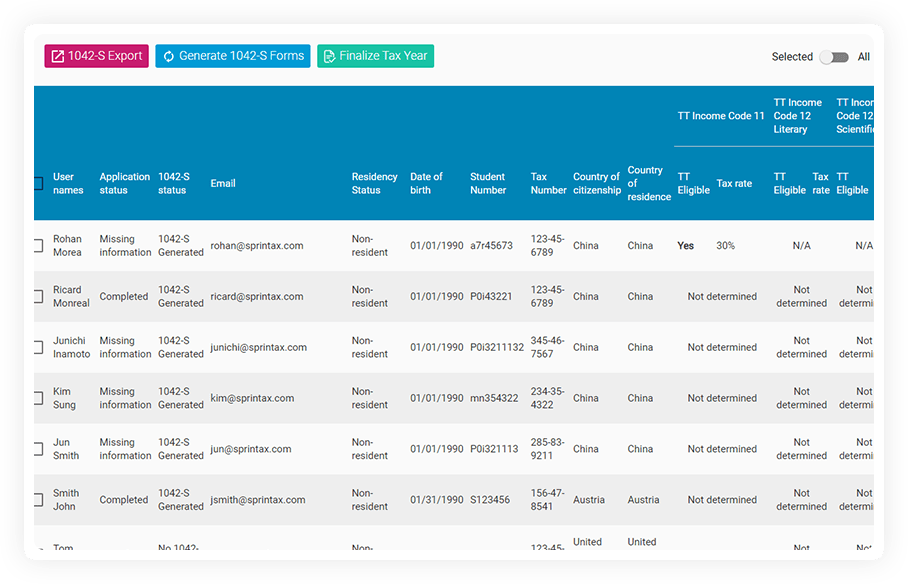

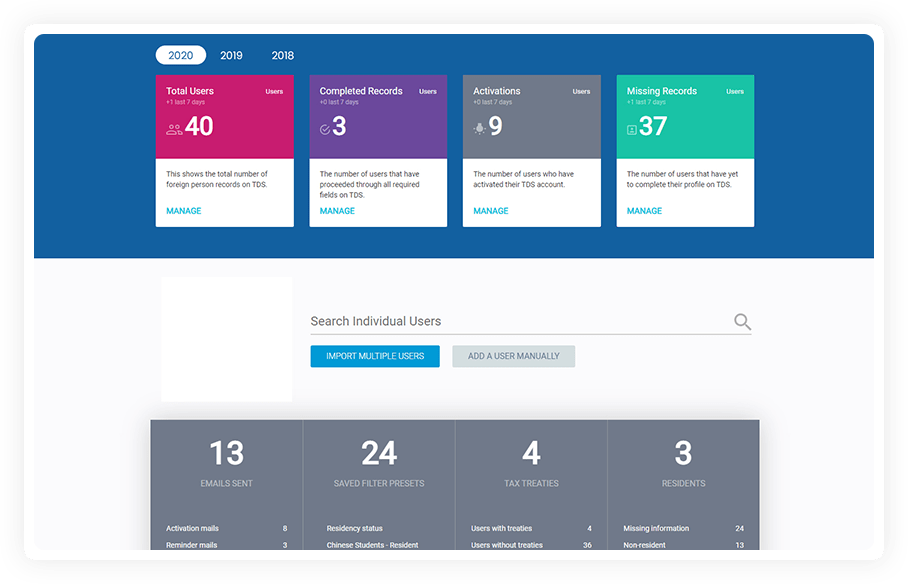

Reporting

Access real-time data and consolidate your nonresident payroll reporting on a single, dynamic dashboard. Gain actionable insights into your nonresident population with advanced reporting that informs future planning and resourcing.

Technology

We’re leading the way in non-resident tax compliance solutions, bridging the gap between tax determination, tax withholdings and payroll. Consolidated to a single, dynamic dashboard, our secure cloud framework ensures your data is protected at all times.

Integration

Create a single source of truth by integrating Sprintax Calculus with your payroll and HR solutions. Reduce the risk of administrative error and create operational efficiencies by automating the secure flow of information via our API.

Recent reviews

Easy, straightforward

Extremely easy, convenient and straightforward for nonresidents. I have used multiple tax softwares but Sprintax has been the best and never disappointed.

2nd time with Sprintax, 100% recommend!

2nd time processing my J-1 taxes and their service never failed me (got my last year’s refund already, now waiting for this year). Even their post-payment is amazing! Valentin helped me with all my questions and answered them in detail. Five-star service! This might be my last filing with them since I left USA already but 100% would recommend their services to any J-1 interns like me who want to file smoothly AND maximize their tax refund!

Sprintax is helpful

I encourage that international students use Sprintax to file their tax returns. Be patient and do not panic. Sprintax provides a live chat feature that guide users through each step. Good luck!

Great experience I have gathered. Both Bot and chat agents have done a great job. I am really happy with Sprintax

It was totally helpful. Both bot and living agets have done a great job. They provided my instant solutions. I was novice but I did it very correctly with the help of Sprintax team. Thank Sprintax!

Great Tool!

The Sprintax website was really easy to use. I had no problem sorting my taxes with the Sprintax questionnaire, and the additional YouTube videos were really helpful

That was great experience in live chat

That was great experience in live chat, they responded me on 30 questions in about 10 minutes, that was so helpful!

My experience with the Sprintax team…

My experience with the Sprintax team was great. First of all Allison has helped me to solve my issue, answered my email promptly and was super kind and polite. It is clear how Allison and the Sprintax team are prepared to serve when any demand occurs. I am Glad I could reach you out easily.

Recommend to all international students!

I only write review when i feel good (or bad sometimes). but the user interface of Sprintax is very friendly and it makes my returning-tax experience simple and fast. The instruction is easy to follow, and the live chat I had at 9 pm with Ivelin Danev was extremely helpful and trustworthy. Thank you for providing the service.

It was good experience

For someone new to all of this the website was easy to deal with, although I needed some help from the online support, they were too helpful and guided me patiently throw the process.

Very easy for the user

Made doing my taxes for the first time as an overseas alien very easy.

Excellent service

This is my first time filing my taxes as a J1 Visa holder. Customer service is amazing! I have reached them out several times with a lot of questions and they have always kindly helped me out.

Friendly chat with agents

Friendly chat with agents. Easy to operate. Save time.

Sprintax makes it easy for me to file…

Sprintax makes it easy for me to file and report my tax. For my some-periods of stay in the U.S., this platform provided me not only convenience and a user-friendly interface but also a brief knowledge of the tax system itself. What I like the most are the e-Form filing and the post-submit troubleshooting service. Overall, a great experience deserving 5 stars! Thank you.

You must use Sprintax!

Great, kind, and knowledgeable chat assistants! Even the AI chatbot gives very useful guide and tips. Sprintax is super intuitive to use—it’s an absolute time saver!

Hard tax return case fully supported

I had a case of partial fund allocation and my employer's accounting firm wrongly deducted an additional half of my taxes. Since then it's been a 2-year long journey combatting with the state tax board and IRS to get my money back and with lawyer support it'd cost me a fortune. Thankfully, I purchased Sprintax support to assist with disputing the case. And though it did require constantly asking for status updates, and estimates, and signing a bunch of papers to get support but in the end it WORKED! I did get my money back, and very very happy about it! Thank you Sprintax! The only wish/recommendation I have is more proactively keeping in touch with clients during these hard cases.

Five Star tax service!

Sprintax was the reason why I accomplished my taxes smoothly and got a refund more than the amount I expected! Great overall service. Joanna and Grace answered all my tax concerns too!

Sprintax: Fast, Neat and Great!

This is the second time I am filing my tax return and I can see that Sprintax has displayed a whole array of mechanisms and systems in place to help me go through the different steps to complete my tax return. Initially, I did not believe I could ever finish this in one day! I think they are extremely professional.

Easy for first timers

First time filing taxes as an international student. Very straightforward and simple process.

Very positive experience!

I’m a rising senior and used Sprintax to file my Federal and State taxes in the US, and had a great experience both times. Sprintax made my life much easier, because it allowed me to file these complicated forms with ease! I definitely recommend it to every International student in the United States.

First experience

As an International Visitor in my first experience, it was easy to understand and answer all the questions. Thanks for the support and instructions.

A fluid experience

A fluid experience. I am relatively new to the tax filing system in the USA, however, I was able to file my taxes with a few instructional videos, articles provided from my school, and the FAQ section. Would strongly recommend fellow international students to use to file their taxes.

Sprintax is a great tool for filing US Taxes

Sprintax is a great tool for filing state and federal taxes in the US. Their interface is very user-friendly and I found the customer chat service really useful for asking any doubts.

Nice and easy.

This year was the second time I used Sprintax. I am kind of new to tax filing, but Springtax made things easy for me. I was able to do everything by using instructional videos, emails from my college, and the FAQ. I strongly recommend international students use Springtax.