Reclaim cross-border Dividend Withholding Tax

All in one solution for individuals and organizations earning share income internationally

Request a Demo

How Sprintax Dividends

can help

Dividend Withholding Tax (DWT) is typically withheld from dividend payments made to overseas investments.

A government will withhold this tax as it is not possible to collect the amount due once the dividend is remitted outside the country.

However, much of this tax is recoverable by refund.

Sprintax Dividends is specifically designed to help individuals and organisations alike to file a tax return and claim their DWT back.

Maximum DWT refund guaranteed

Sprintax will ensure that the maximum tax refund is returned for both your team and your organisation

Peace of mind for you and your employees

Forget endless hours of tax paperwork. The Sprintax team will guide you through the DWT refund application process

Simple online process

Investors can apply for their DWT refund easily online – no complicated paperwork

Full tax compliance guaranteed

Sprintax will ensure that you have a clean tax record by preparing all necessary tax documents in compliance with local tax regulations

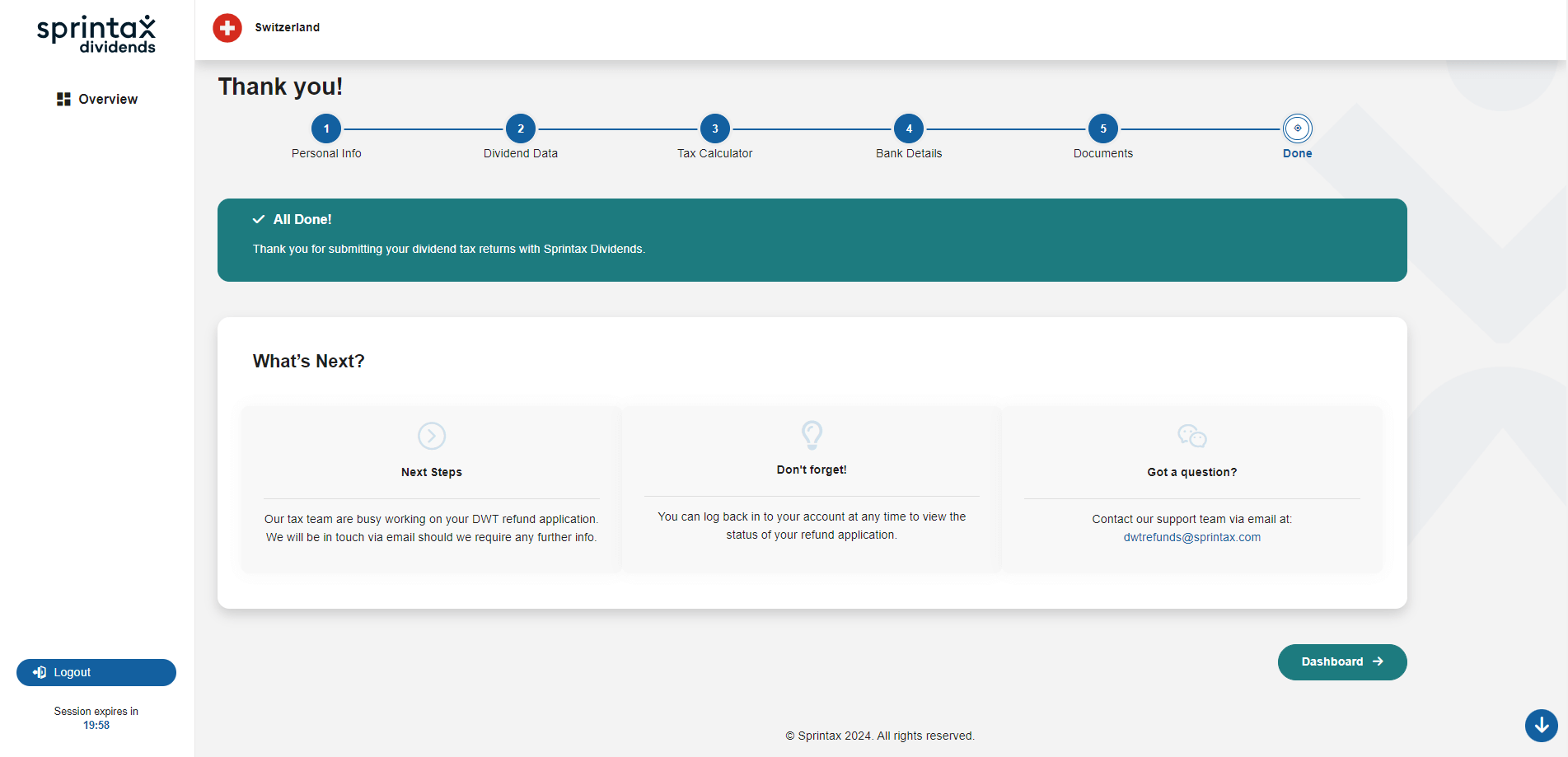

How it Works

01

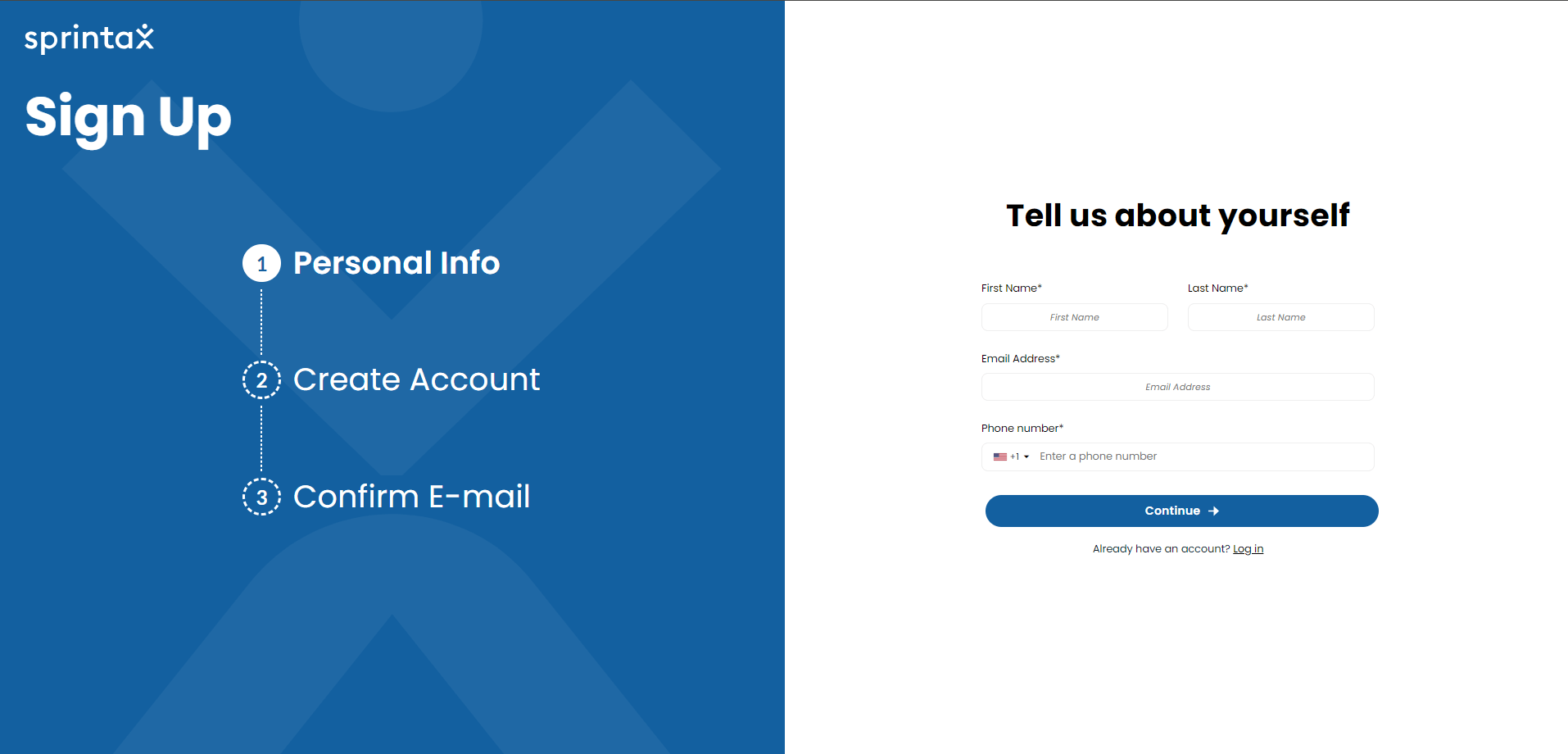

Create your account in minutes02

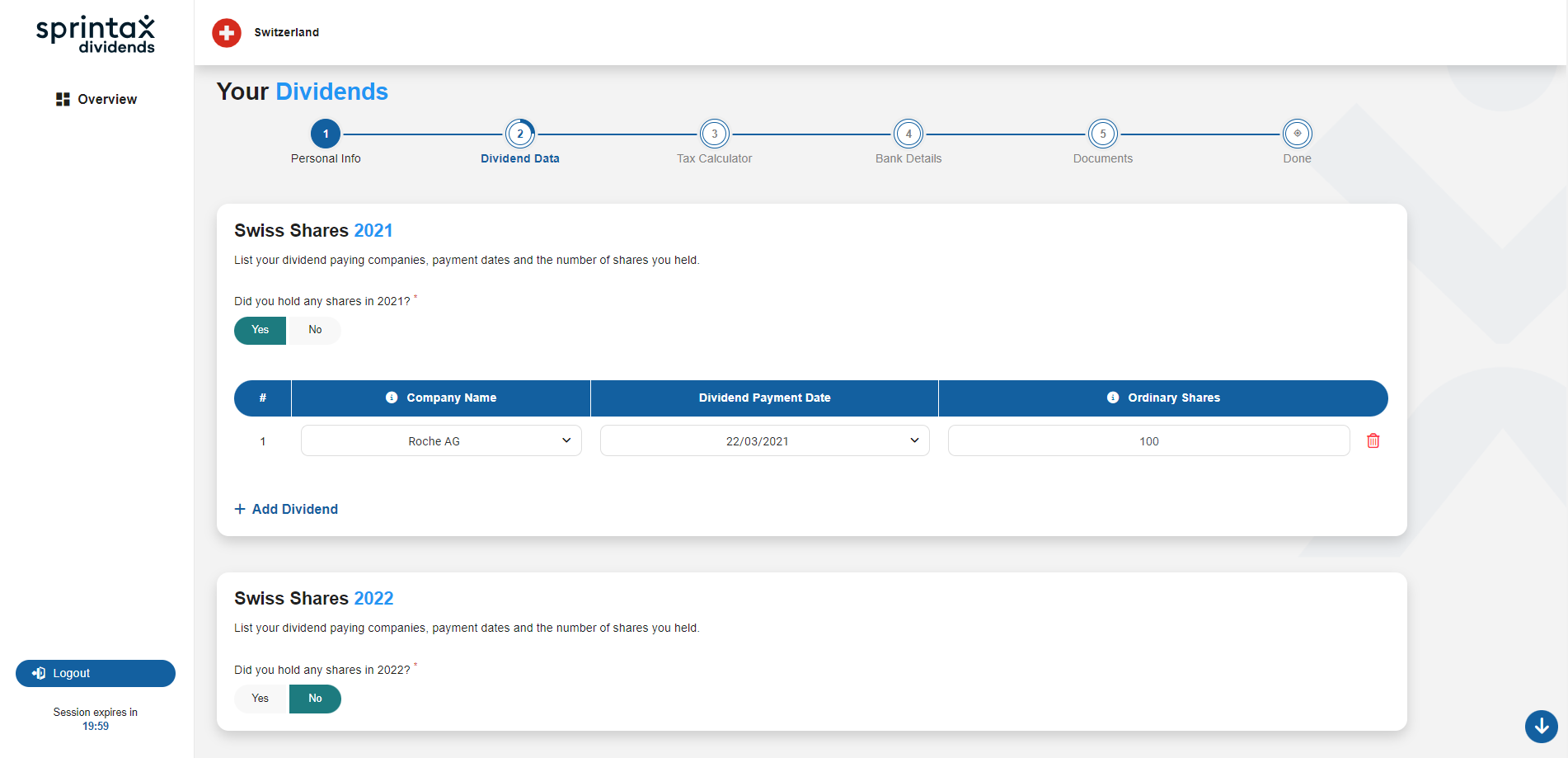

Answer some questions about your cross-border investments and dividends yield03

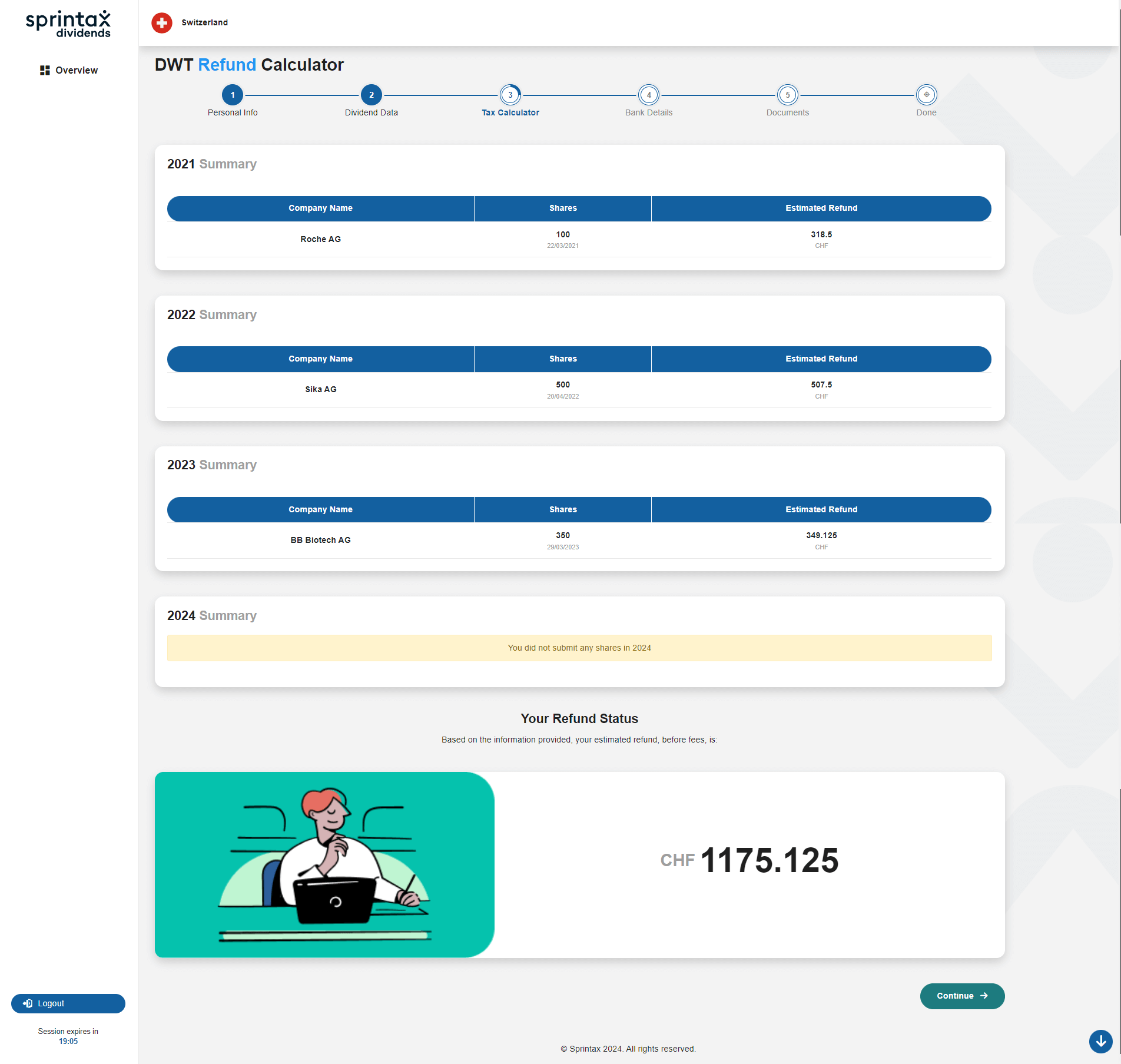

Sprintax applies every deduction and treaty benefit you are entitled to04

Sprintax prepares and files your completed tax return05

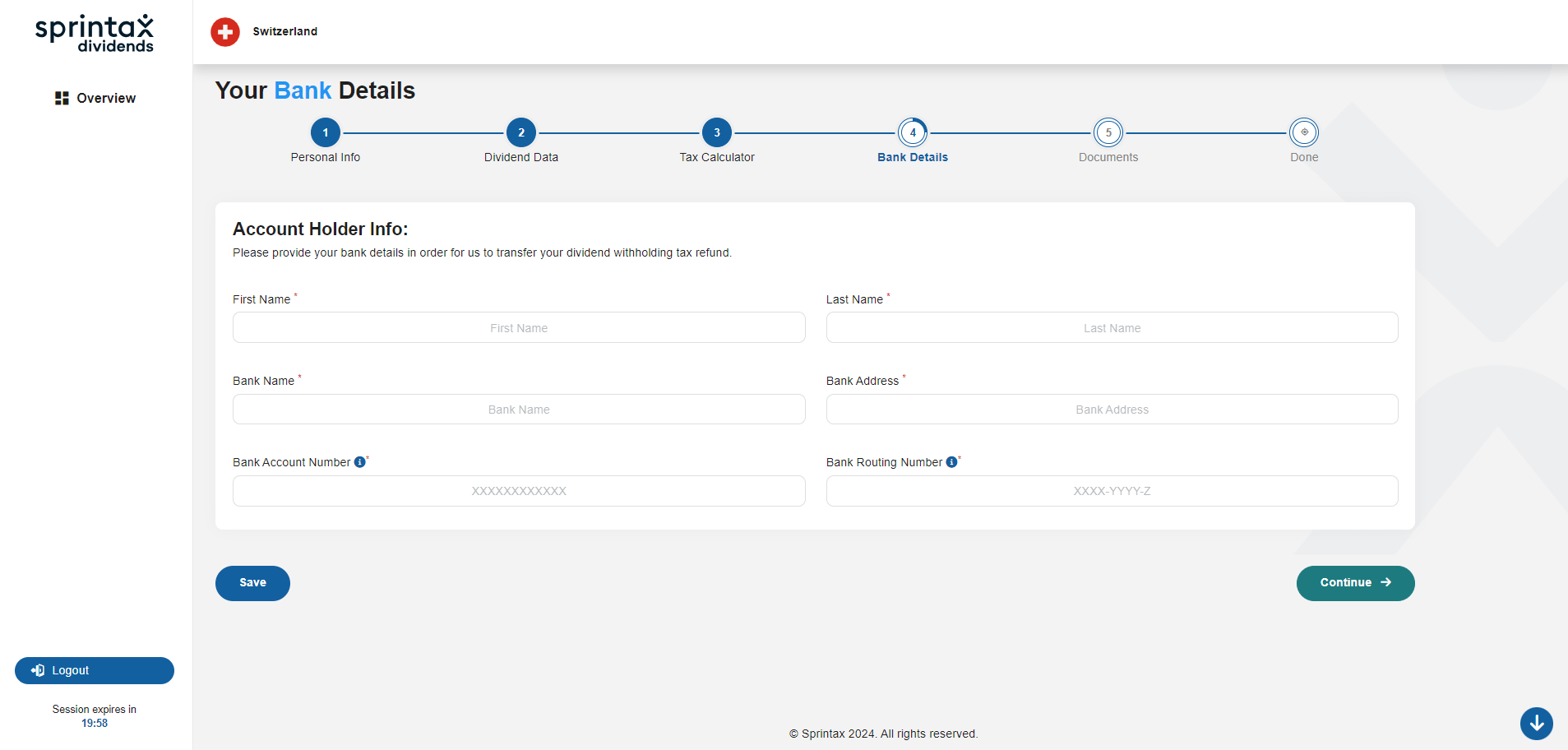

Sprintax transfers your refund straight to your bank account

Dividend Withholding Tax FAQs

No.

DWT rules vary from country-to-country. Some countries impose higher tax rates than others while other countries (such as the UK) do not charge DWT at all.

If you are unsure whether DWT has been withheld from your dividend payment, the Sprintax software will help you to determine whether or not you are due a refund.

Exactly how much tax that will be withheld will depend on the country in which the investment is located.

For example, a DWT rate of 30% for investments located in Australia. Meanwhile, the rate in China is 10%.

No matter the rate of dividend tax withheld, Sprintax will ensure you receive your maximum DWT refund.

Let’s take a look at a case study.

A US-based investor holds shares in a Swiss company which pays a gross (before withholding tax) dividend of CHF 1,000.

Before the “gross dividend” is credited to the non-resident investor, 35% withholding tax will be deducted from the dividend.

This means that only CHF 650 will be transferred to the non-resident investor.

This after-tax amount is known as the ‘net dividend. As the US has a tax treaty agreement with Switzerland, it’s like that this investor will be entitled to a tax refund.

The amount of tax that can be reclaimed depends on several factors, including:

1) where the non-resident investor resides for tax purposes

2) the tax status of the non-resident investor (such as an individual, a company, a pension fund, a partnership, etc.)

3) the percentage of shares of the dividend-paying company that are held by the non-resident investor.

A tax treaty is a an agreement made by two countries to resolve issues involving double taxation of passive and active income of each of their respective citizens. Income tax treaties generally determine the amount of tax that a country can apply to a taxpayer’s income, capital, estate, or wealth.

Many treaties provide for an exemption from (or a reduced rate of) withholding tax on dividends paid to certain investors.

This process whereby the lowest applicable withholding tax rate is imposed on a dividend payment is referred to, typically, as “relief-at-source.”

Some countries (such as Ireland and the United States) utilize relief-at-source mechanisms; however, many countries do not.

In such instances, non-residents must pay withholding tax on dividend payments at the full tax rate determined under domestic law and file tax documents in order to reclaim any over-withheld tax.

Each country has its own defined “statute of limitations” that provides a deadline within which a non-resident tax reclaim must be filed.

Generally, statutes of limitations are between two years and six years from the calendar year in which the dividends were paid. But, as we mentioned above, these rules vary from country-to-country.

As a result, if a non-resident investor has been receiving dividends from companies organized in one or more foreign countries for a few years, the potential amount to be reclaimed could be substantial.

At Sprintax, we specialize in tax recovery.

Our sophisticated software has been designed specifically to help investors in navigating the often complicated and confusing processes involved in reclaiming DWT from overseas.

We will guide you though the process of availing of your refund, correctly preparing all of the paperwork you need for your application.

To get started, simply complete the short form here.