Reclaim your withheld dividend tax easily online

Sprintax Dividends has been developed specifically to support nonresidents in DWT refund applications

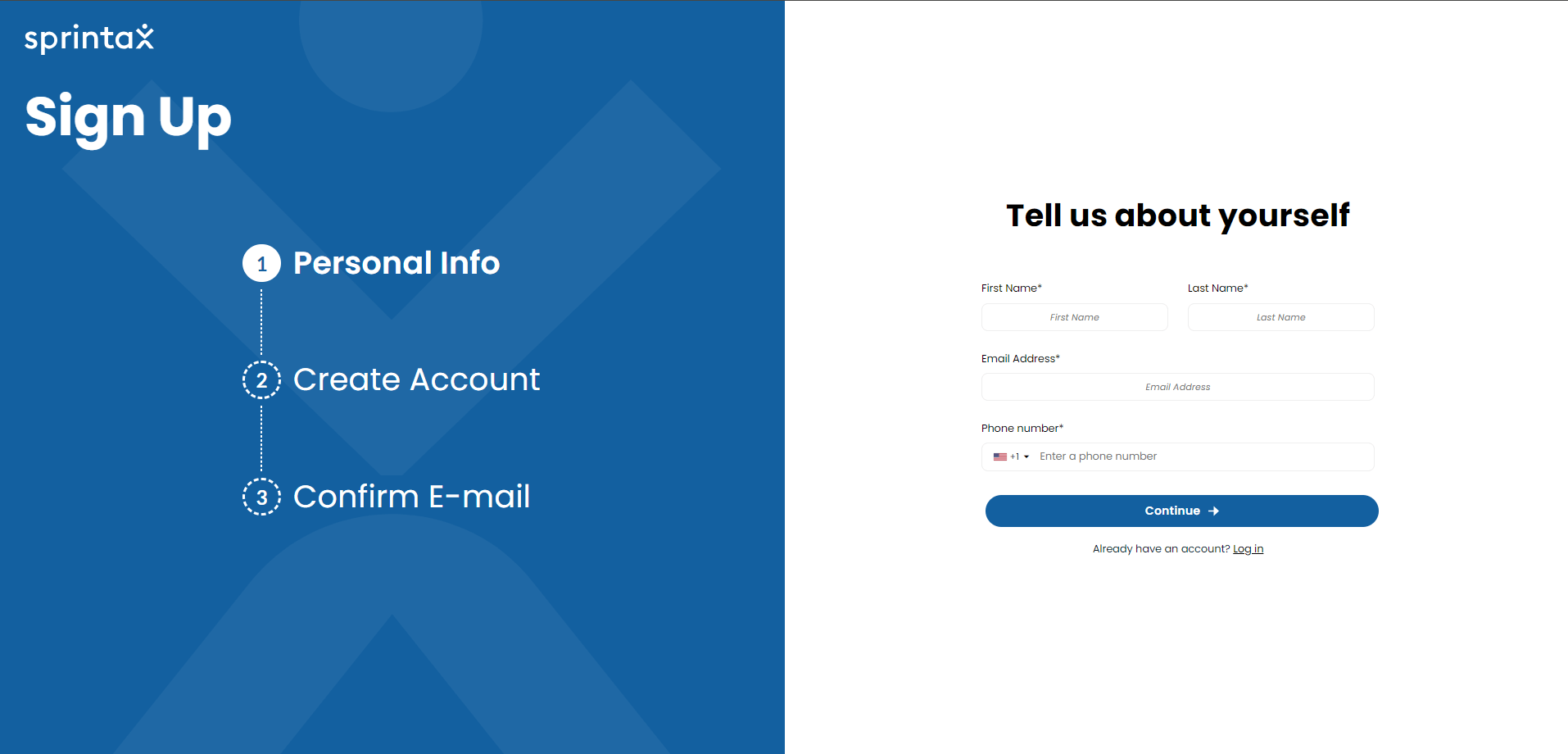

Create your account

How Sprintax Dividends supports investors

At Sprintax, we have created an innovative software which guides international investors through the process of reclaiming dividend withholding tax.

By registering with Sprintax and answering some simple questions about your investment, our system will support you in securing your maximum DWT refund.

Your maximum Dividend Withholding Tax refund guaranteed

Sprintax Dividends will ensure you receive everything you’re entitled to

Forget complicated tax paperwork

You can easily apply online with Sprintax

Ensuring full tax compliance

You will have full peace of mind that your tax paperwork has been prepared correctly

‘Round-the-clock support

Got questions about your specific tax situation? The Sprintax Live Chat team is available 24/7 to support you

How it works

01

Create your Sprintax Dividends account02

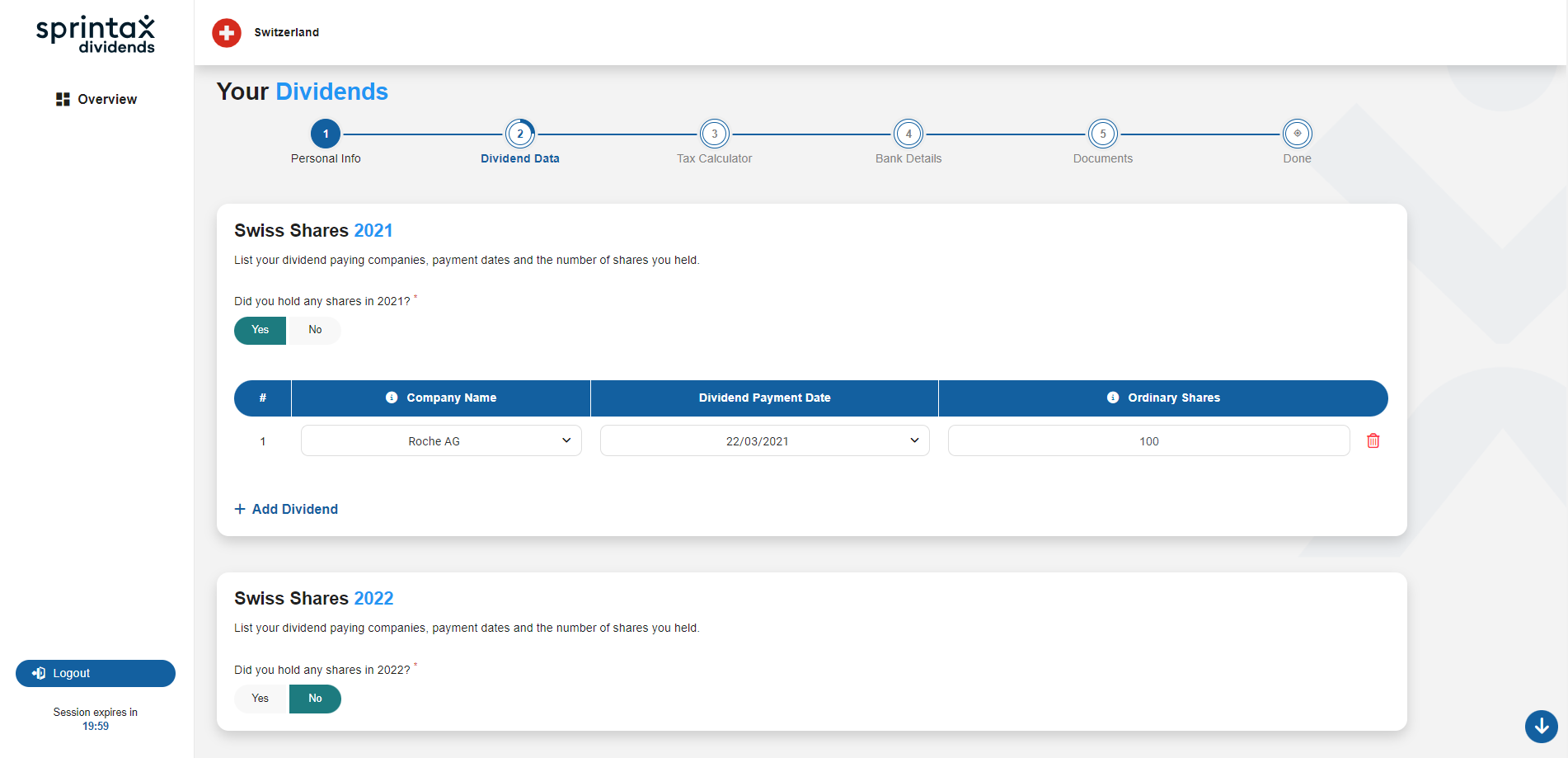

Quickly complete our easy online questionnaire by answering some straightforward questions about your investment03

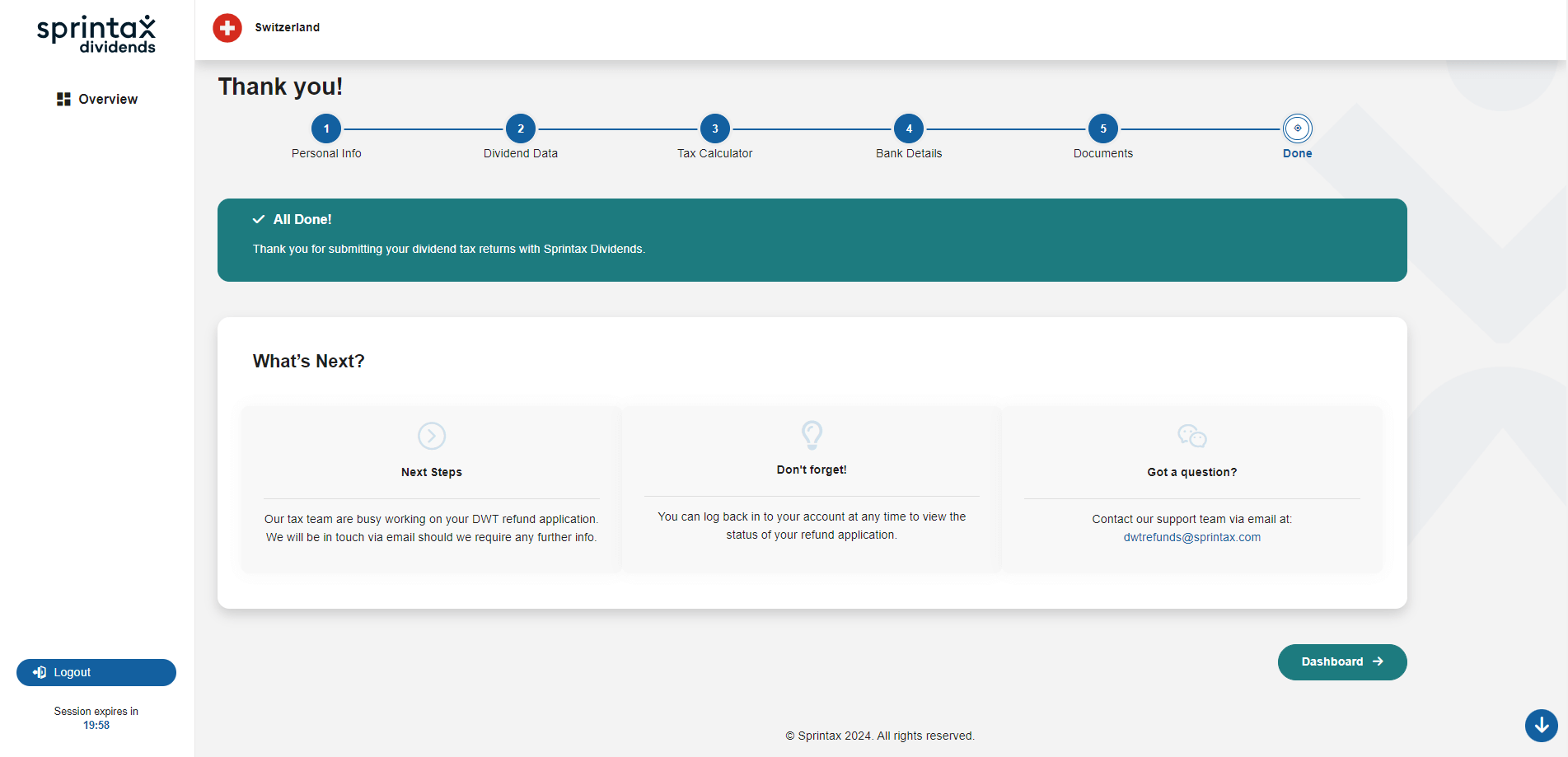

Our software will prepare and file your refund application with the relevant tax authority04

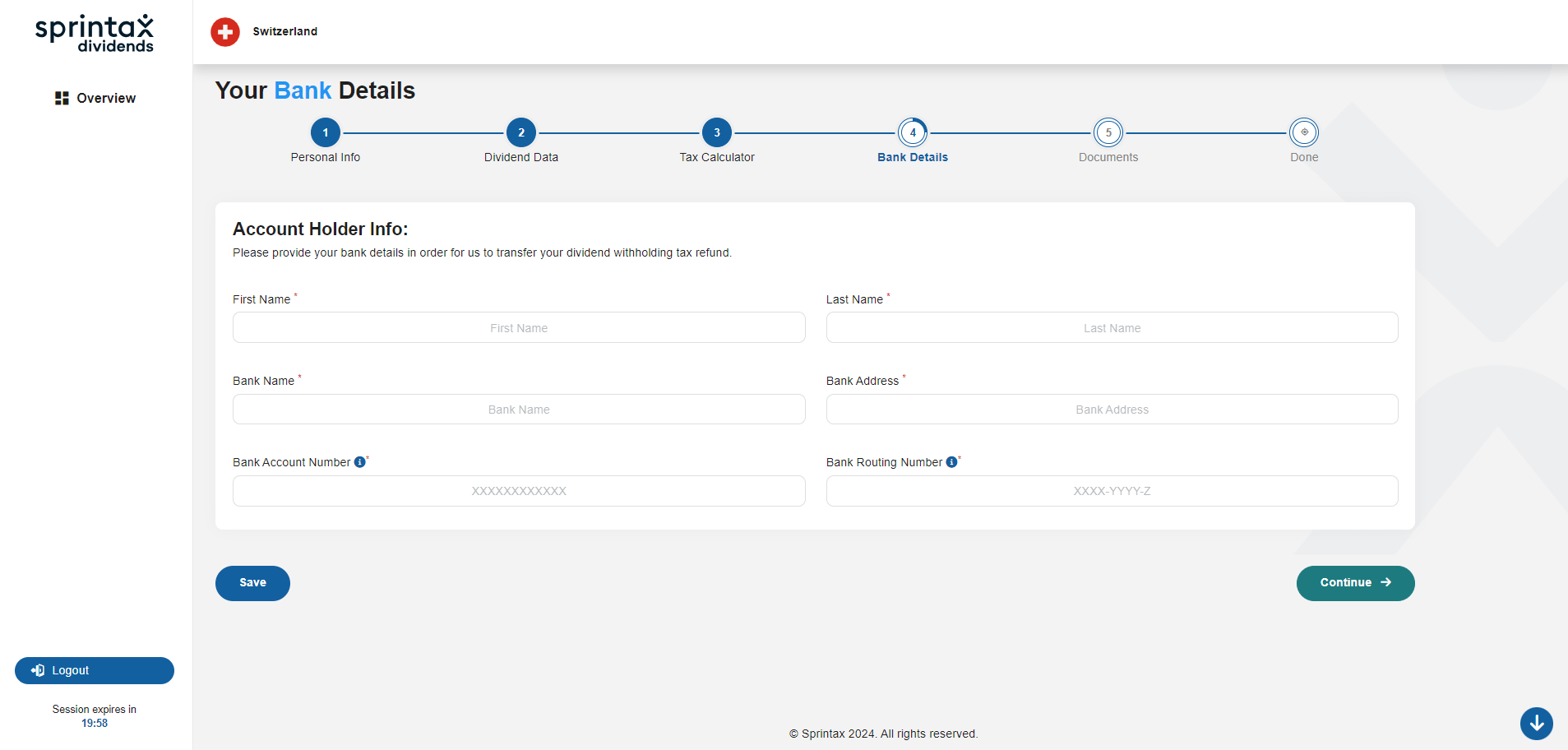

Sprintax will transfer your refund straight to your bank account

Dividend Withholding Tax FAQs

Dividend Withholding Tax (DWT) is typically withheld from dividend payments made to overseas investors and employee share option scheme participants.

Exactly how much tax is deducted from your dividend will depend on the location of your investment.

However, the good news is that much of this tax can be claimed as a refund.

Many countries impose a withholding tax on dividend payments which are transferred to international investors.

Governments impose this tax as it is their best opportunity to withhold tax before the dividend payment leaves the country.

The answer to this question will depend on the country in which the investment is located.

For example, a DWT rate of 25% applies for investments located in France and 26.4% in Germany. Meanwhile, the rate in Mexico is 10%.

The amount of tax that can be reclaimed depends on several factors, including:

- Where the nonresident investor resides for tax purposes

- The tax status of the non-resident investor (such as an individual, a company, a pension fund, a partnership, etc.)

- The percentage of shares of the dividend-paying company that are held by the non-resident investor.

If you reside in a country that has an income tax treaty with the country that taxed the dividend, and that treaty provides a lower tax rate as compared to the tax rate imposed on the dividend you received, you should be eligible for a refund of the excess tax withheld.

For example, if you are a US resident and receive dividends from an employee share scheme sponsored by a Swiss parent company, 35% tax will be deducted from your dividend payment and remitted to the Swiss government.

However, through the US-Switzerland tax treaty agreement you can benefit from a 15% tax rate on dividend payments. This means that you are due a 20% refund from the Swiss government, but you must file a refund application to receive it.

The answer to this question will depend on your specific investment, the country in which it is located and the tax that was deducted.

For example, France applies a tax rate of 25% on dividends paid to nonresidents. Meanwhile, the tax rate in Switzerland is 35%.

So, if you have received a dividend payment of $5,000 from a Swiss company it is likely that a tax rate of 35% will have been applied before you received the payment (therefore the total payment is worth $7,692).

However, exactly how much you will be entitled to claim will also depend on your country of residency and whether said country has a tax treaty agreement with the country in which the investment is located.

When applying for a refund of dividend withholding tax, you will need to have the following information on hand:

- Name

- Address

- Email address

- Social Security Number

- Dividend statements

- Bank account details (in order to receive your refund)

You may also need to provide some details relating to your federal tax return.

At Sprintax, we support hundreds of international investors in reclaiming their dividend withholding tax easily online.

Our sophisticated software will guide you through the process of availing of your refund, correctly preparing all of the paperwork you need for your application.

To get started, simply complete the short form here.

If you have investments in multiple countries, Sprintax can help you.

We file refund applications for most countries that impose dividend withholding tax on nonresident investors.

Typically, DWT refund applications take 6-12 months to be completed.