Manage your nonresident

employee payroll easily online

with Sprintax Calculus

All in one solution for corporations with international employees and vendors

Request a Demo

How Sprintax Calculus

can help

The documenting and withholding on payments to nonresident employees has become an increasingly important function for US organizations.

With this in mind, we have developed Sprintax Calculus to help payroll departments to easily manage the tax profiles of their nonresident employees on a single, user-friendly dashboard.

Sprintax Calculus ensures organisations and their nonresident employees remain compliant with IRS regulations.

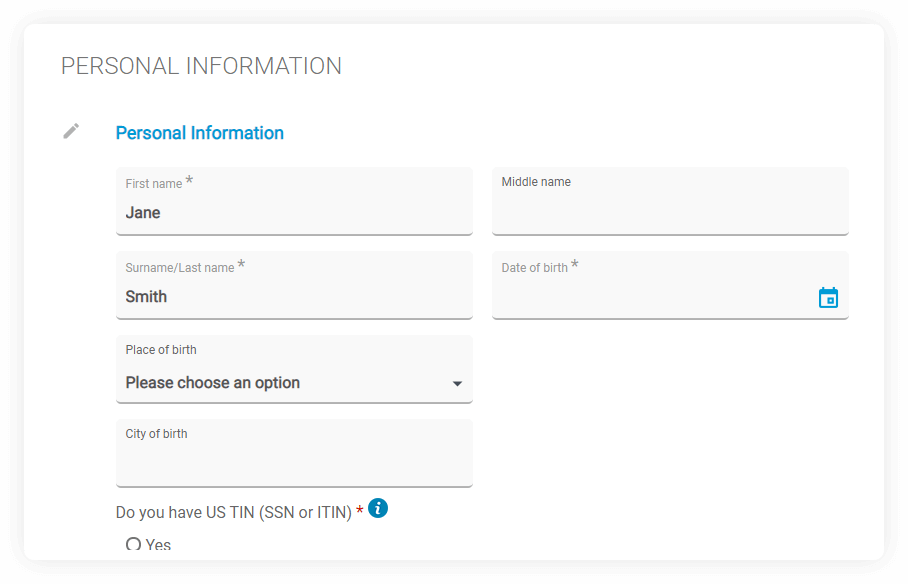

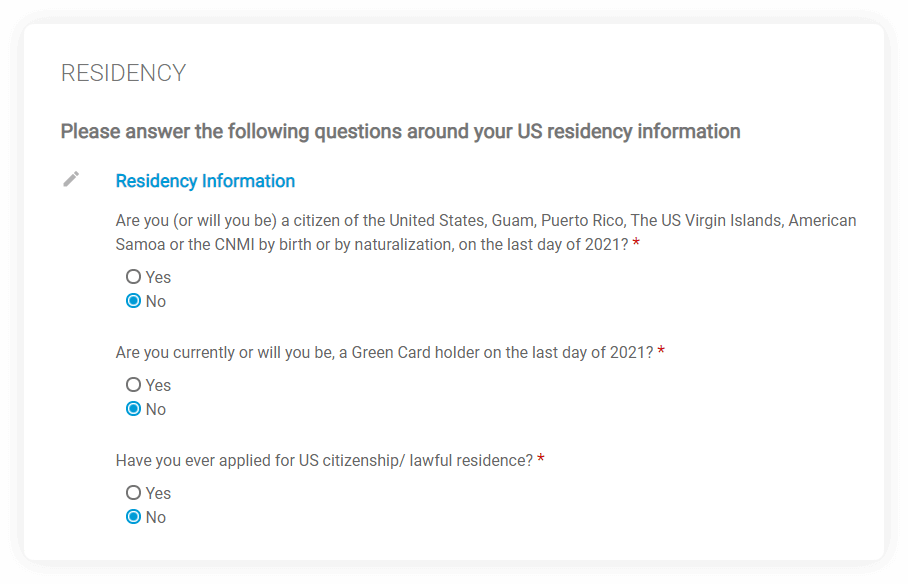

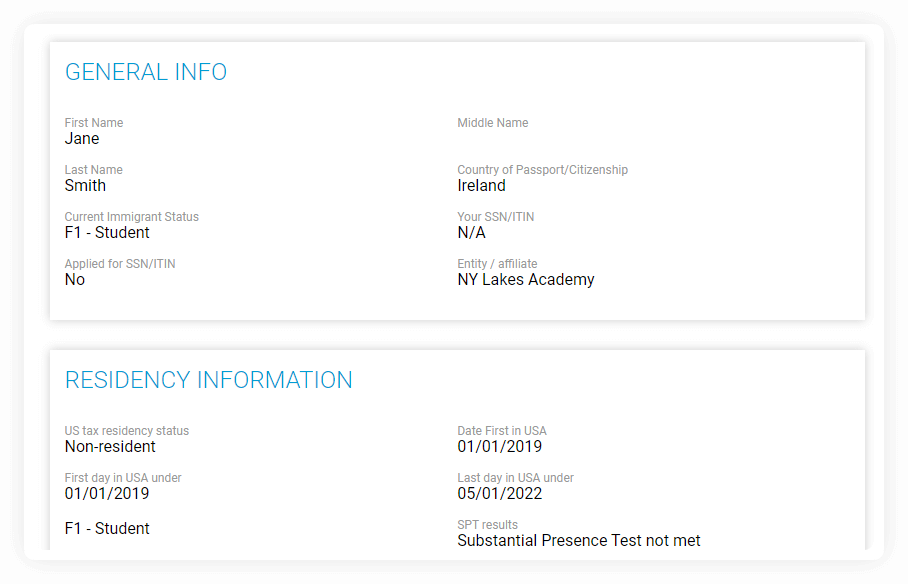

In addition, the system will aid your employees in determining their residency status and tax treaty benefit entitlements.

Login anywhere, anytime!

Cloud-based, secure and automated nonresident tax solution.

Calculates tax withholding

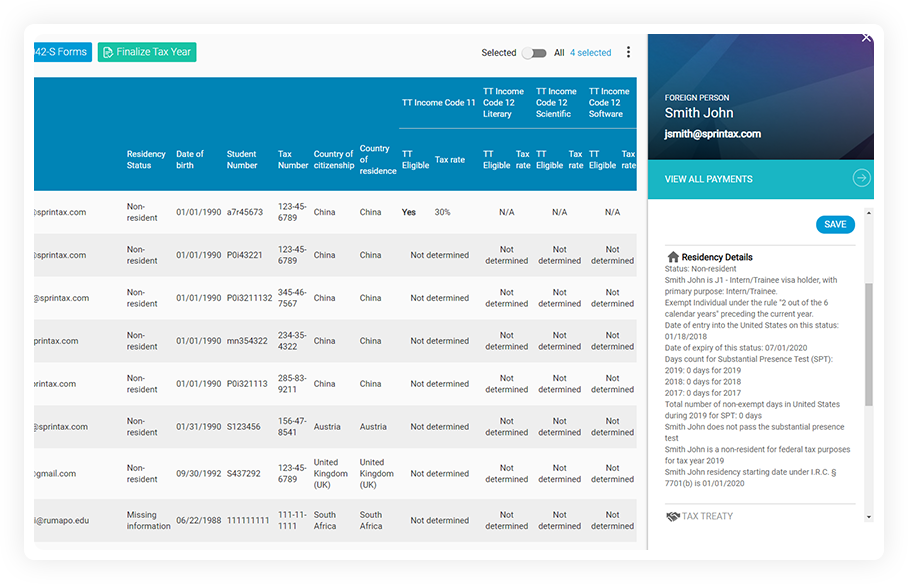

Our system calculates nonresident tax withholding and determines whether they are eligible for any tax treaties or deductions.

Nonresident tax compliance guaranteed

Instant generation of tax forms (such as 1042-S, W-4, W-8BEN and more).

Tax residency determination

Determines tax residency status, based on the substantial presence test.

Easy to use admin & dashboards. Advanced reporting tools

Personalized reporting and management of your nonresident tax profiles.

How It Works

Here's what our customers think

” Sprintax has been a welcome addition to the processing of our Institutions Non-Resident Alien (NRA) employees. The cloud-based software is user-friendly, and the knowledgeable support staff is quick to answer any questions you might have. NRA employees are able to submit all of their information and supporting documents for verification and Tax Treaty determination online. At year-end they are able to access their 1042S Forms via their online account and use TDS Sprintax to file their annual tax return if desired. Program views can be tailored to your needs and reports can be easily extracted for analysis and verification. Overall, Sprintax has proven to be an effective way to efficiently maintain our NRA employee files in a cost-effective manner. “

Lance Brissette,

Sr. Payroll Financial Analyst, University of Toledo

Frequently Asked Questions

Sprintax Calculus is a dynamic, adaptive, dependable and trusted system that has been specifically developed to help organizations to manage the tax withholding of their international employees.

With Sprintax Calculus, your Payroll Department can easily manage the tax profiles of your nonresident employees all-in-one place, through a user-friendly dashboard.

To date we have partnered with over 450 organisations in the US to help them manage the taxation of their nonresident employees.

Sprintax Calculus frees up precious time and resources for your Payroll Department and International Office staff.

Employers can ensure that the correct amount of tax is withheld from their nonresident employees and reported to the IRS.

Meanwhile, our system will aid your foreign employees in determining their residency status for tax purposes and their entitlement to tax treaty benefits, ensuring that they are taxed correctly from the first paycheck.

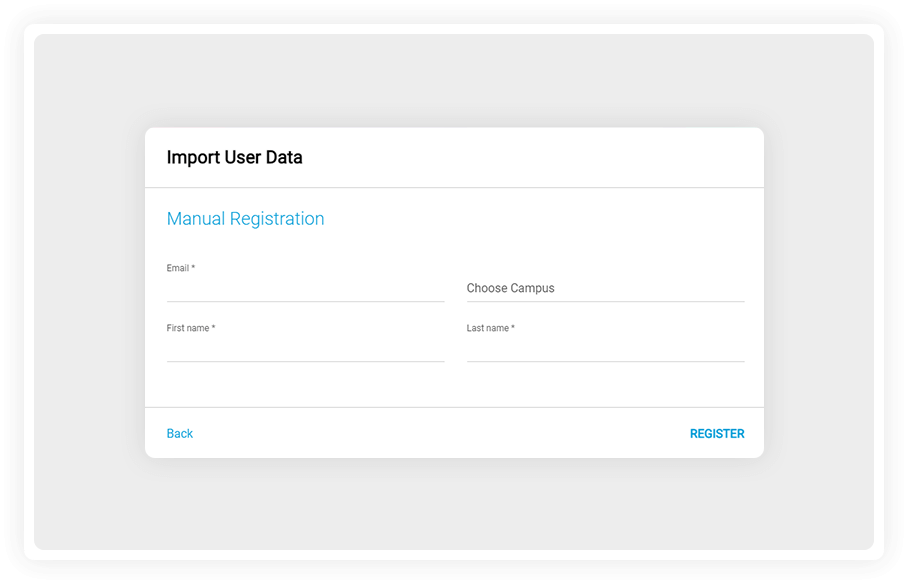

What’s more, with our API integration, your transition to Sprintax Calculus will be seamless. You can freely pull data from your payroll software to our system and vice versa.

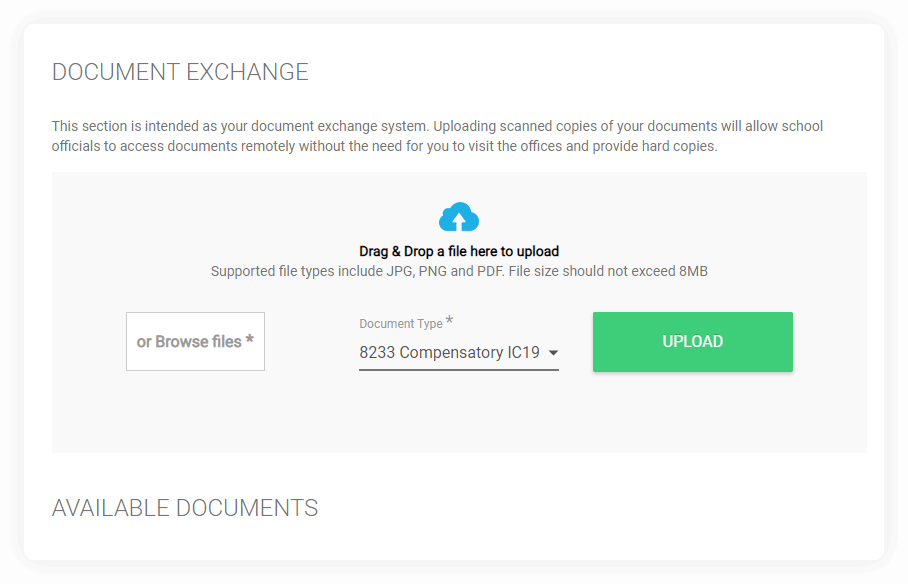

Sprintax Calculus will prepare every document your payroll office requires in order to manage the taxation of your nonresidents.

Our system will provide your foreign nationals with all applicable tax forms such as W-4, W-8BEN and 8233.

1042-S forms will be automatically generated and converted to PDF.

Sprintax Calculus can also prepare SS-5 or W-7 forms upon your request.

No!

Sprintax Calculus is a cloud-based product. That means no software installs necessary. Instead, you can login to your account from anywhere at anytime.

Who is entitled to a tax treaty? What does that entitlement mean to them and to you as an employer? No need to be familiar with tax treaties and regulations, all of them are included in Sprintax Calculus!

What’s more, the implications of tax treaty eligibility for the individual employee and you as an employer are clearly outlined within our system.

Why not register for a free, no obligation demonstration of Sprintax Calculus? A member of our team will be happy to walk you through our system and answer your questions.