Work and travel tax compliance simplified

Comprehensive federal and state tax filing support for

J-1 visa agencies and exchange program sponsors

Tax help for program participants

Sprintax ensures that work and travel program participants – including J-1 students, cultural exchange visitors, au pairs, and camp counselors – remain fully tax compliant in the U.S.

Nonresidents can use Sprintax Returns to e-file their federal tax return, prepare state tax paperwork and claim tax treaty benefits.

$1,184

$1,184

Average federal refund

1m+

1m+

Federal tax returns filed

700

700

School & corporate partners

203

203

Nationalities assisted

Why tax compliance matters

Many nonresidents arrive in the U.S. unsure of their tax obligations. But work and travel compliance is essential.

Correct tax filing by nonresidents:

ensures a clean U.S. tax record

prevents late-filing fines or IRS penalties

avoids complications with future U.S. visa applications

How to ensure tax compliance for work and travel participants

Every nonresident in the U.S. is required to file tax documents each year.

This includes J-1 program participants, au pairs, interns, seasonal workers and other temporary visa holders in the U.S.

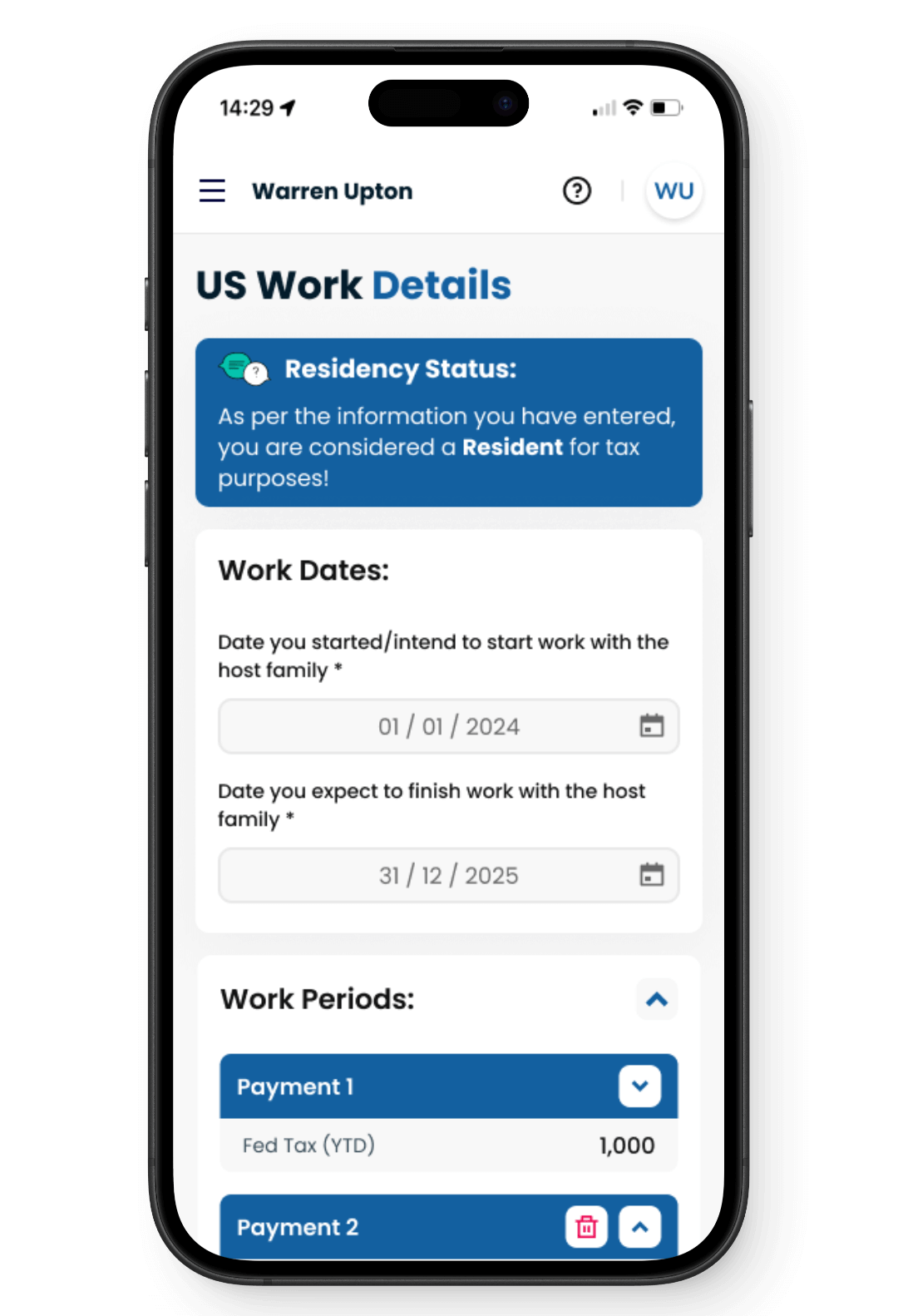

At Sprintax, we have developed a nonresident tax filing solution specifically to guide your program participants through the process of filing their tax documents.

By registering with Sprintax, nonresidents can be confident they are fully compliant with the IRS.

Learn more

How Sprintax helps?

Full IRS compliance

Full IRS compliance for exchange visitor programs

Bulk filing

Bulk filing for work and travel groups

J1 tax refund

Tax refund processing for J-1 workers

User-friendly admin

Admin dashboard for participant tax tracking

Tax resources for Work & Travel participants

Taxation of work and travel participants

No.

Every nonresident in the U.S. must file tax documents with the IRS – whether or not they earned income. This includes J-1 visa holders, interns, trainees, au pairs, camp counselors, and exchange participants.

No.

Work and travel participants are usually considered to be nonresidents for tax purposes. Nonresidents are not required to pay social security or Medicare tax while in the U.S.

TurboTax does not offer international exchange program tax support.

TurboTax has been developed specifically to guide U.S. citizens and residents through the process of filing their tax return.

Nonresidents are not able to file a compliant tax return using TurboTax.

Sprintax is the official nonresident tax filing partner of TurboTax. Our software will help your nonresidents to prepare the tax documents they need easily online.

When filing their tax return, work and travel program participants will need to have the following information on hand:

- Passport

- US entry and exit dates

- All tax forms (including Forms W-2, 1042-S and/or 1099, etc.)

- Visa / Immigration Status information (such as Form DS-2019)

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)