Starting work in the U.S.? Prepare your tax forms

Sprintax Forms helps you prepare your W-4, 8233, W-8BEN and other employment forms in minutes

From $24.95

How does Sprintax Forms help nonresident workers?

When you begin working in the U.S., your employer will ask you to complete several tax forms. These forms determine how much tax is withheld from each paycheck, so it’s important to get them right.

With Sprintax Forms, you can prepare all required documents online in just a few minutes, accurately and with confidence. The system also determines your U.S. tax residency status and identifies any tax treaty benefits you’re eligible for, ensuring correct withholding from day one so you keep more of what you earn.

Accurate tax withholding

01

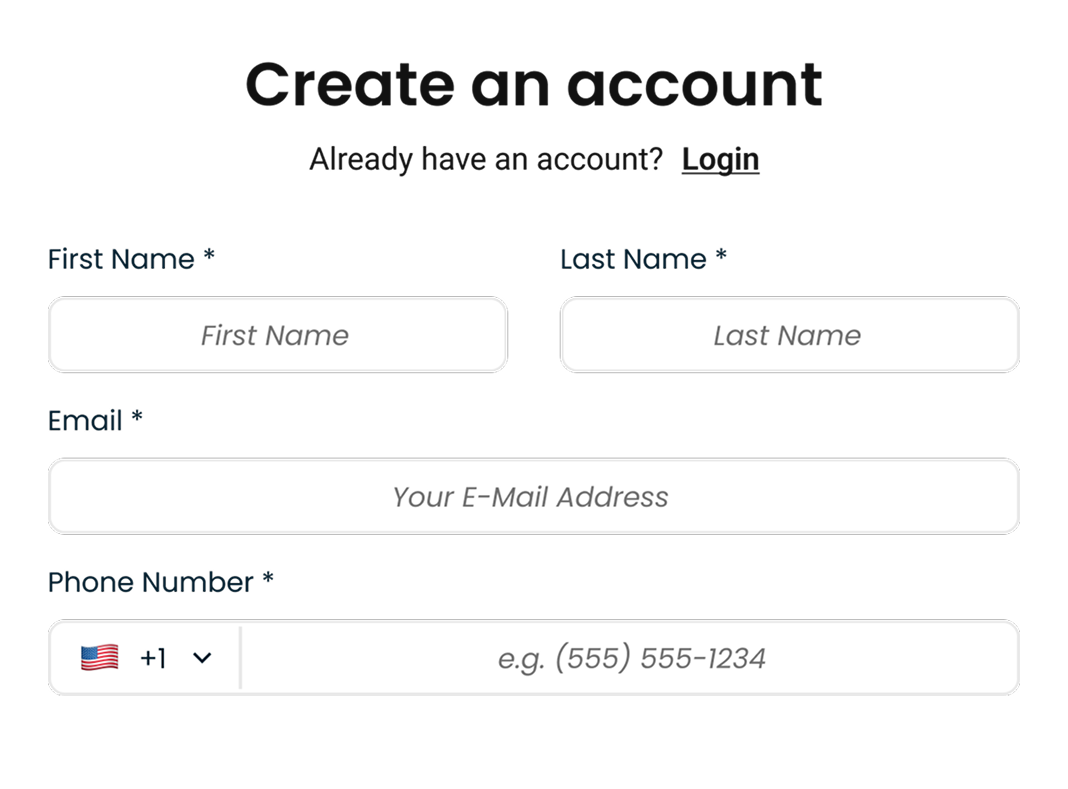

Create your account

Create your Sprintax Forms account here.

02

Tell us about you

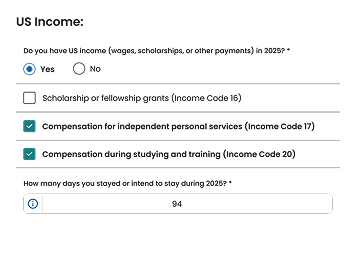

Provide details about your tax residency, visa program and employment details by answering a few quick questions.

03

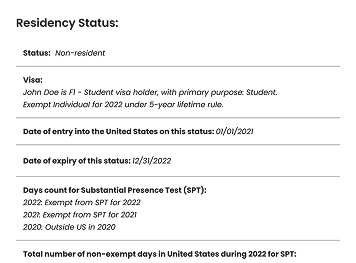

Tax profile determination

We determine your tax residency status, tax treaty eligibility and generate the forms you need, such as your W-4, 8233, W-8BEN and more.

04

We prepare your tax withholding calculations

Our software calculates accurate tax withholdings based on your personal tax profile and employment details.

05

Download your completed paperwork

Download, print and sign your pre-employment US tax forms, ready to present to your employer.

Who does Sprintax Forms support?

Sprintax Forms helps nonresident individuals stay compliant with U.S. tax regulations, from determining residency status to generating accurate tax forms. Whether you’re on OPT, CPT, a J-1 program, or earning income as an Au Pair, camp counselor, or from royalties, the system automatically prepares IRS forms like the W-4, 8233, and W-8BEN. It ensures correct tax withholding at source and full compliance with federal and state requirements.

International students & scholars

J1 work & travel

Interns & trainees

Au Pair & camp counselors

Royalties

Why choose Sprintax Forms?

Form filing made simple

Automatically generate all the pre-employment tax forms you need – such as W-4, 8233, W-8BEN and more, in just a few simple steps.

Get taxed correctly

Avoid overpaying on your tax bill. We’ll ensure the right amount is withheld from each paycheck.

Maximize your tax treaty benefits

Sprintax Forms helps you claim every treaty benefit you’re entitled to. We will also check if you qualify for FICA tax exemptions.

Expert support

We provide a range of support materials including live chat, Q&A webinars, help guides, email support & more.

Tax Forms

Form W-4

Every employee working in the U.S. must complete Form W-4 when starting a new job.

This form tells the employer how much federal income tax to withhold from the employee’s paycheck based on their filing status, dependents, and other adjustments.

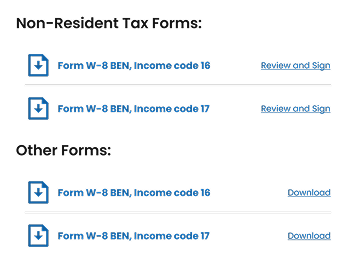

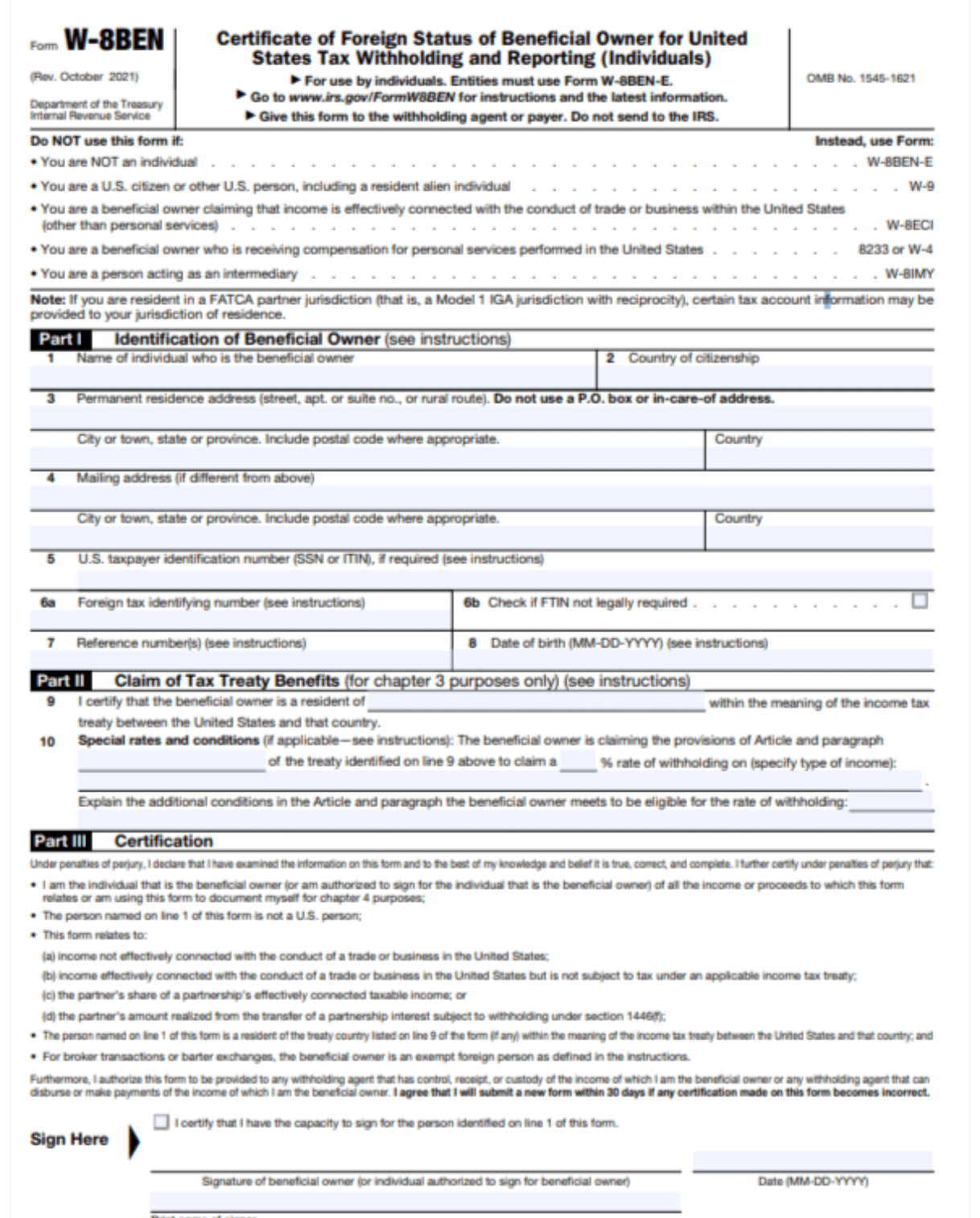

Form W-8BEN

Every nonresident alien or foreign individual earning income from U.S. sources must complete Form W-8BEN.

This form certifies their foreign status and allows them to claim any applicable tax treaty benefits to reduce or eliminate U.S. withholding tax on that income.

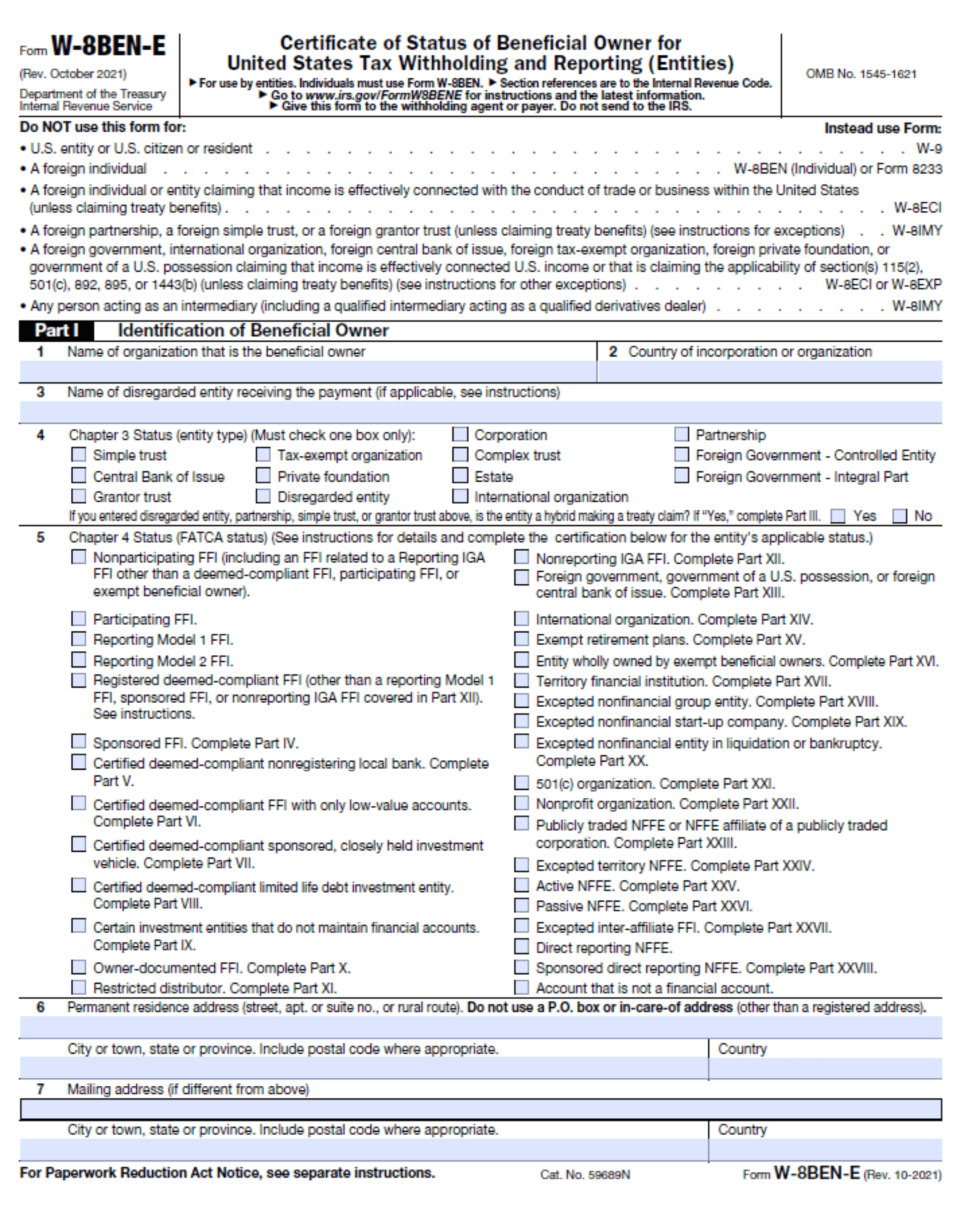

Form W-8BEN-E

Form W-8BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities), is completed by foreign entities that receive income from U.S. sources.

By completing this form, foreign vendors can certify their foreign status and claim a reduction or exemption from U.S. withholding tax by availing of applicable tax treaty benefits on income such as interest, dividends, or royalties.

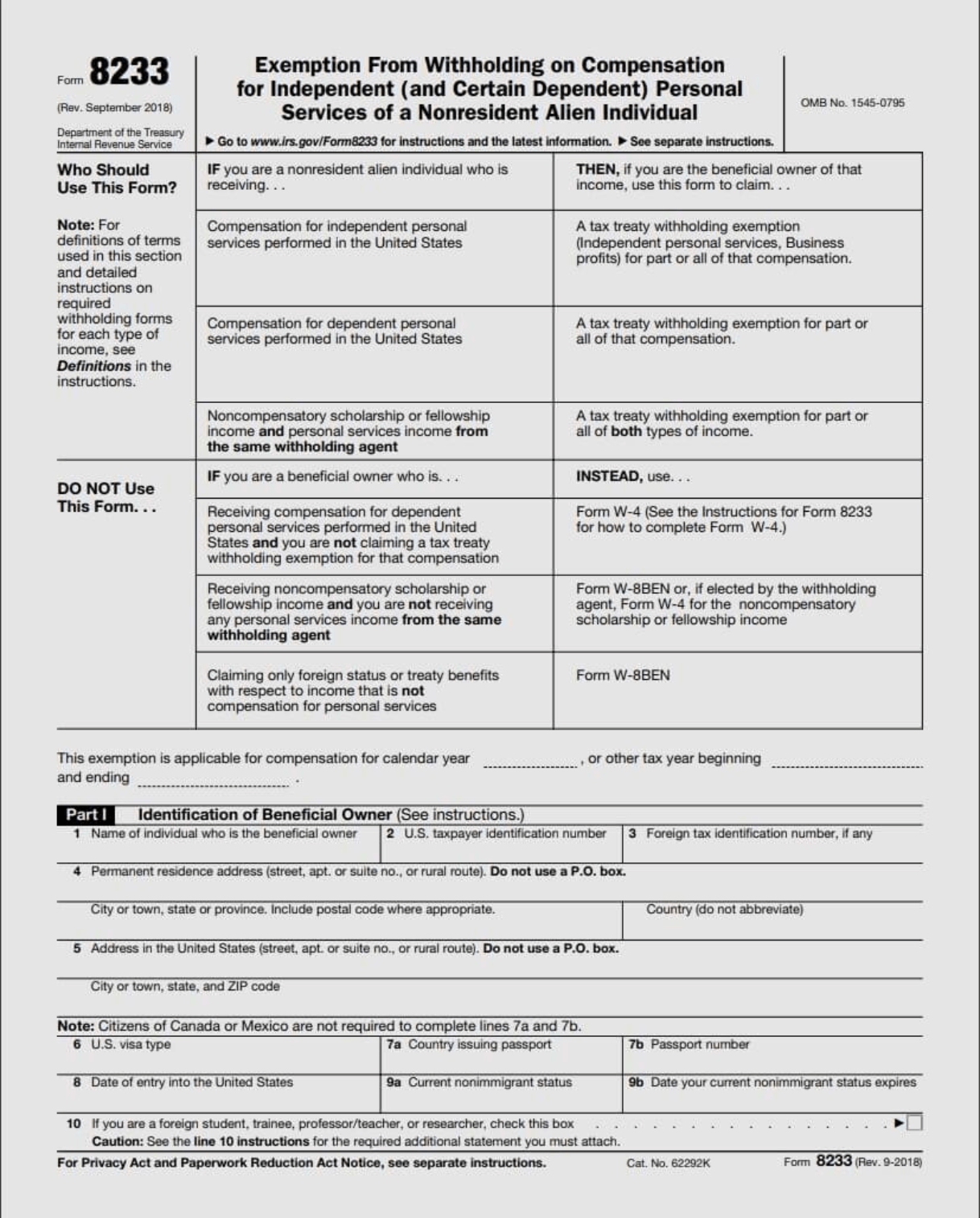

Form 8233

Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual, is required for every nonresident who earns certain types of scholarship, fellowship, or personal services income (including compensatory scholarship or fellowship income from the same withholding agent).

By completing this form, the individual can also claim an exemption from U.S. federal income tax withholding on such income when eligible under an applicable income tax treaty.

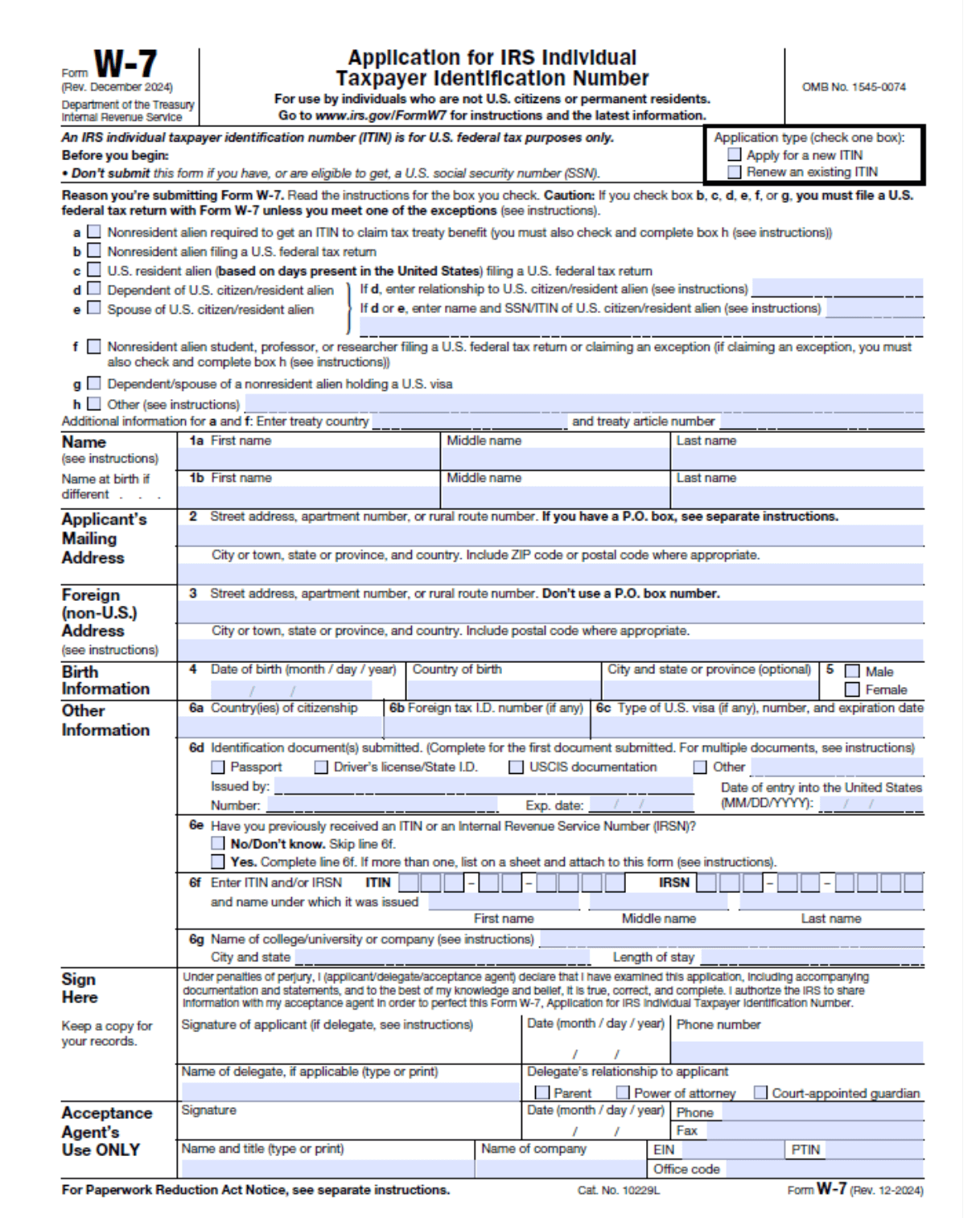

Form W-7

Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN), is used by individuals who are not eligible for a Social Security Number but need a U.S. taxpayer identification number for tax purposes. This form allows nonresident aliens, their spouses, or dependents to file U.S. tax returns, claim tax treaty benefits, or fulfill other U.S. tax reporting obligations.

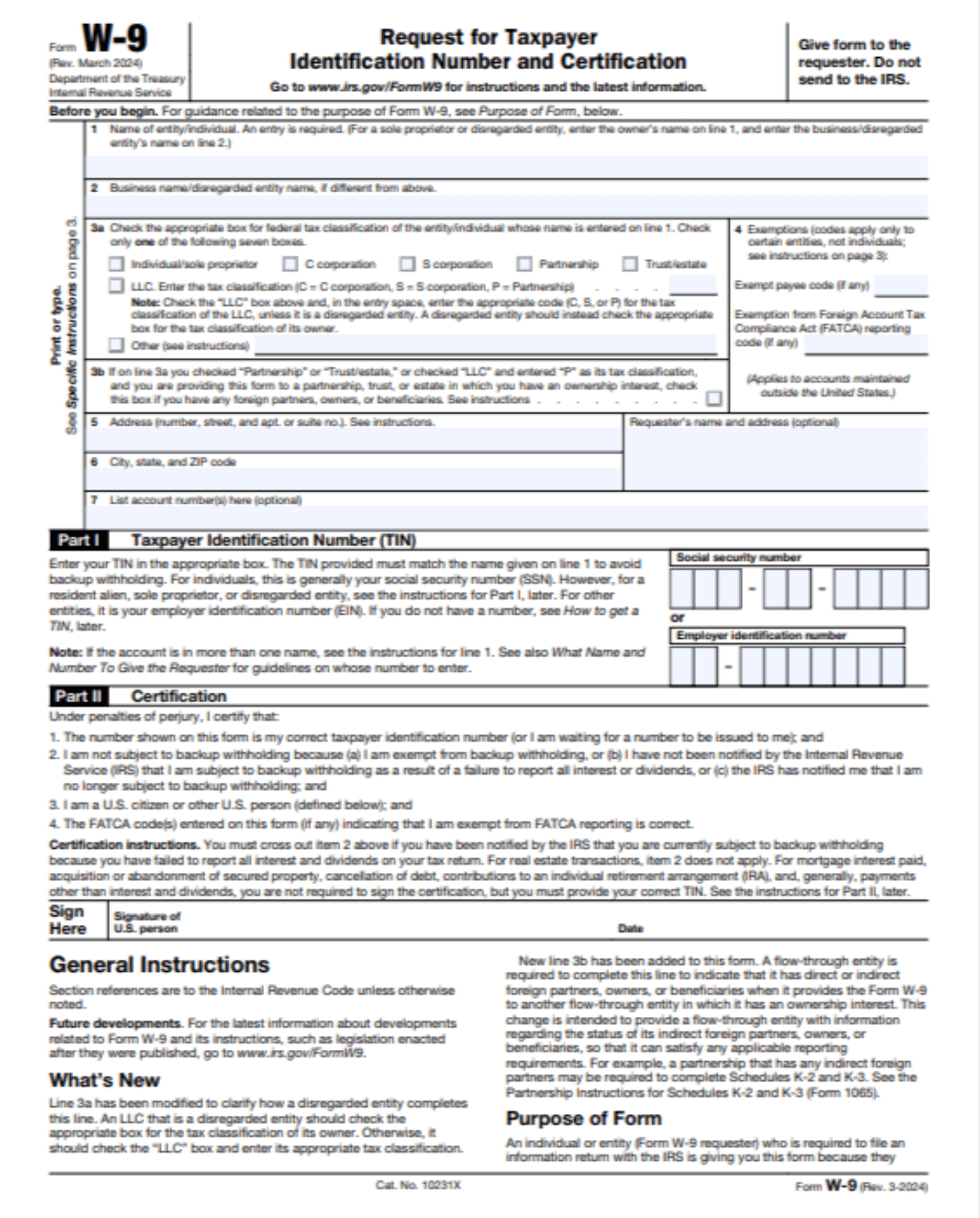

Form W-9

Form W-9, Request for Taxpayer Identification Number and Certification, is used by U.S. persons (including citizens and resident aliens) to provide their correct Taxpayer Identification Number (TIN) to payers. This form allows the payer to report income paid to the individual or entity to the IRS and ensures proper tax withholding and reporting for payments such as salaries, dividends, or contract work.

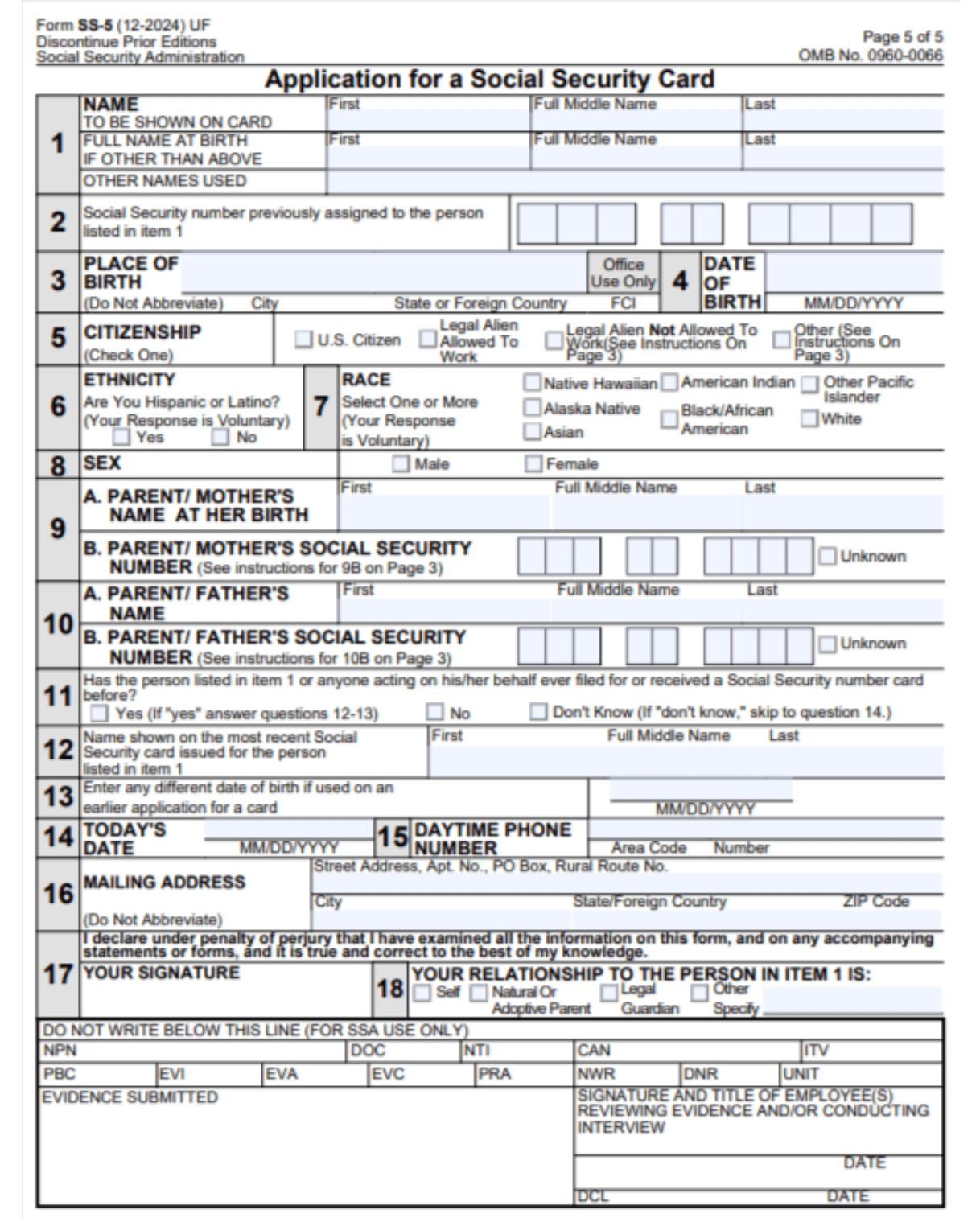

Form SS-5

Form SS-5, Application for a Social Security Number (SSN) Card, is used by individuals to apply for a new or replacement Social Security Number card in the United States. This form is required for U.S. citizens, permanent residents, and certain noncitizens to obtain an SSN, which is used for tax reporting, Social Security benefits, and other government and financial purposes.

Your questions, answered

Sprintax Forms and Sprintax Returns are two essential tools that help nonresidents in the U.S. to stay fully tax compliant with the IRS.

When a nonresident begins working in the U.S., Sprintax Forms ensures they pay the correct amount of tax on their income and claim any tax treaty benefits they are entitled to. Nonresidents can use this platform to prepare the documents they need such as W-4, 8233, W-8BEN and more.

Later, during tax season, every nonresident in the U.S. is required to file tax documents with the IRS. Sprintax Returns has been specifically developed to help these individuals accurately prepare and file their end-of-year tax return.

Sprintax Calculus is our tax determination software for organizations with nonresident employees. The system helps payroll departments to easily manage the tax profiles of their nonresident employees on a single, user-friendly dashboard.

Sprintax Forms can help you to prepare every form you need when starting a new job as a nonresident in the U.S. This includes forms W-4, 8233, W-8BEN and more.

From W-4

The purpose of this form is to determine how much tax should be withheld from your income. It’s very important that this form is completed correctly. When you create your Sprintax account, our software will ensure you complete your W-4 correctly and that you pay the right amount of tax on your income.

Form 8823

This form is used to claim a tax treaty-based exemption from tax withholding on personal services income.

Form W-8BEN

This form proves your status as a nonresident alien and determines your eligibility for tax treaty benefits on Fixed, Determinable, Annual, Periodical (FDAP) income.

The U.S. has signed tax treaty agreements with more than 65 countries around the world. If you are entitled to benefit from one of these agreements, you could potentially save a lot on your taxes.

When you create your Sprintax account, you can easily determine whether or not you are entitled to any tax treaty benefits.

International students, scholars, teachers, professors, researchers, trainees, physicians, au pairs, summer camp workers, and other non-students on F-1, J-1, M-1, Q-1 or Q-2 visas are typically entitled to a FICA exemption.

Sprintax Forms will help you to determine whether you are exempt from FICA tax.

Fees for this service start from $24.95.

When you start a new job in the U.S., you will need to provide some important pre-employment documents to your employer.

These documents will ensure that the correct amount of tax is withheld from your salary. If these forms are not completed correctly, you could end up paying too much tax!

Using Sprintax Forms has many benefits, including:

- Your employment tax forms are generated for you

- Quickly identify your tax treaty eligibility

- Calculate your residency for tax purposes

- Determine if you are exempt from FICA taxes

- 24/7 live chat support to guide you all the way

Yes!

You can easily prepare your U.S. Federal and State tax return online with Sprintax.