Claim your Dividend Withholding Tax refund

Sprintax Dividends is a simple software solution for cross-border DWT reclaim, supporting individual and organizational investors

How does Sprintax Dividends help?

If you earn income through overseas investments – be it via a company ESOP, pension fund or trading platform – you may be subject to double taxation, first by foreign withholding tax and then by domestic income tax. Fortunately, depending on tax treaty agreements between the issuing country and your country of residence, you may be able to reclaim much or all of this tax, further boosting your investment return.

Sprintax Dividends is the simple software solution for reclaiming Dividend Withholding Tax (DWT). With built-in tax logic that accounts for treaty benefits and domestic laws, we calculate your estimated tax refund and prepare your ready-to-file application.

Smart, simple software

01

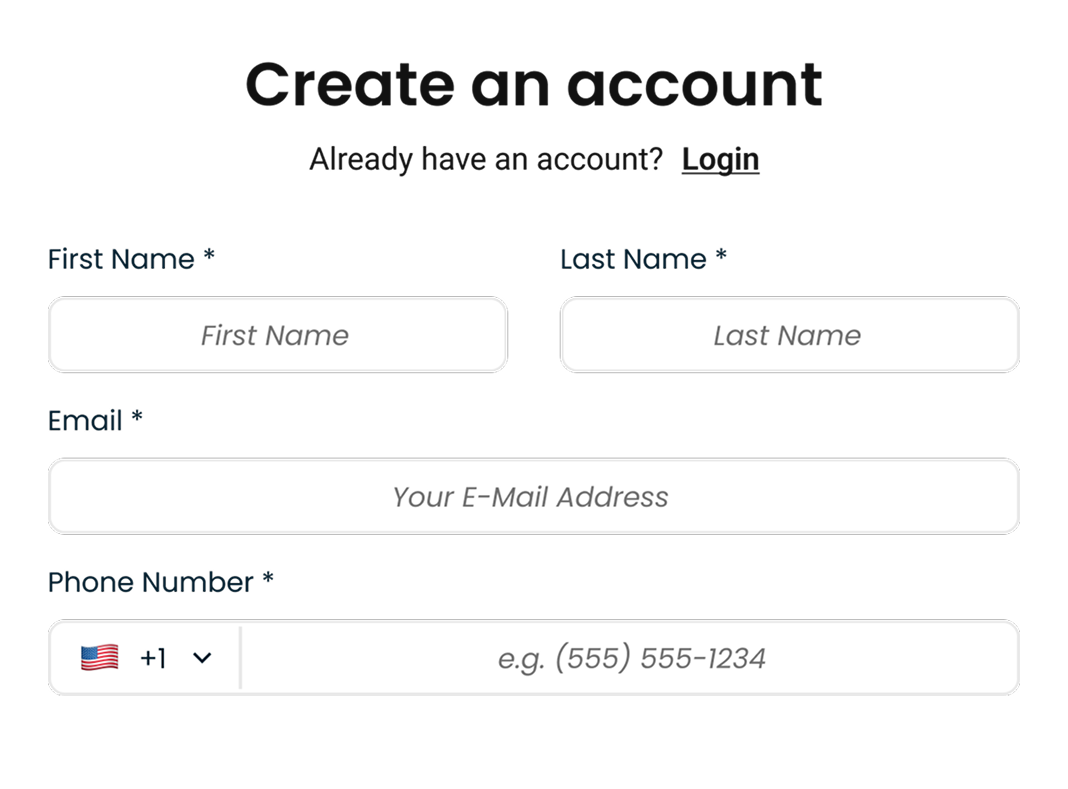

Create your account

Create your Sprintax Dividends account here.

02

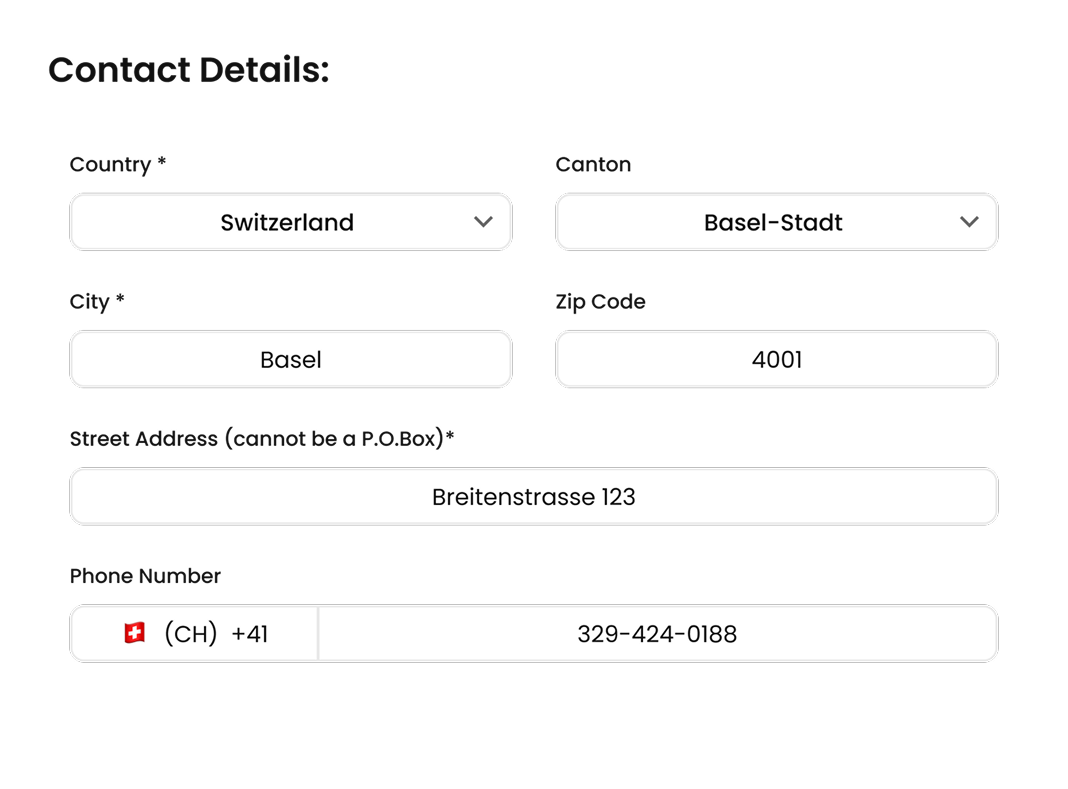

Tell us about you

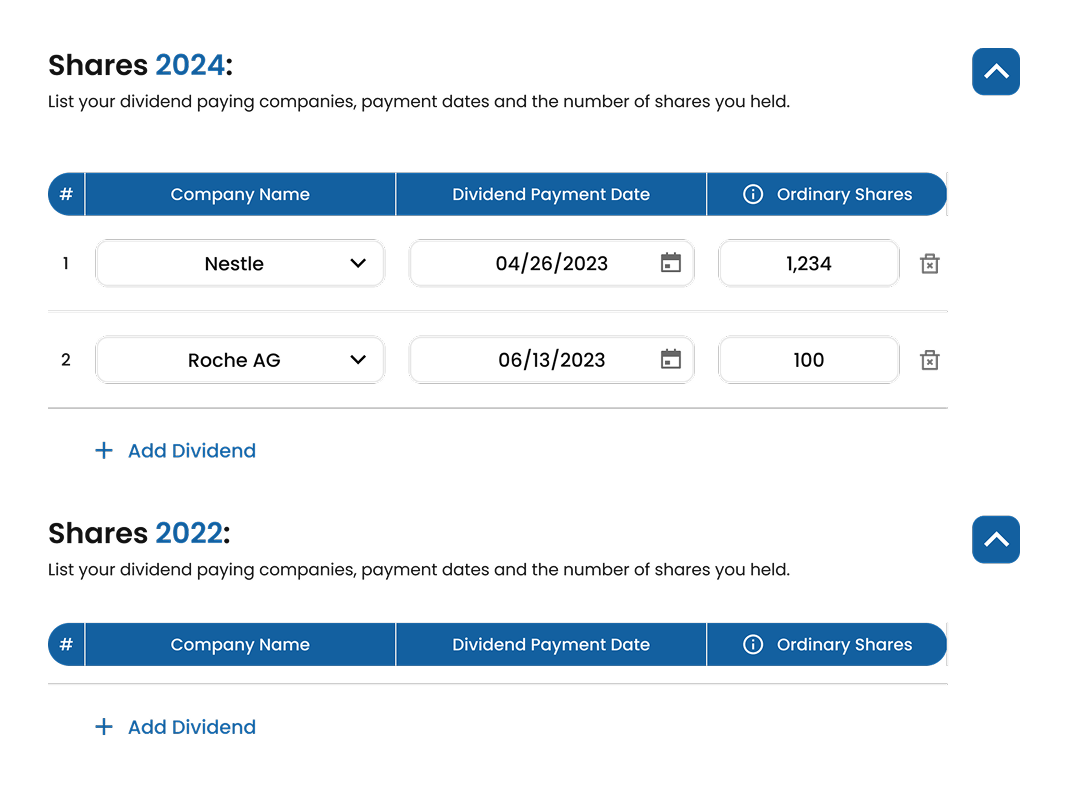

Answer some simple questions about your residency, shareholdings and dividend earnings.

03

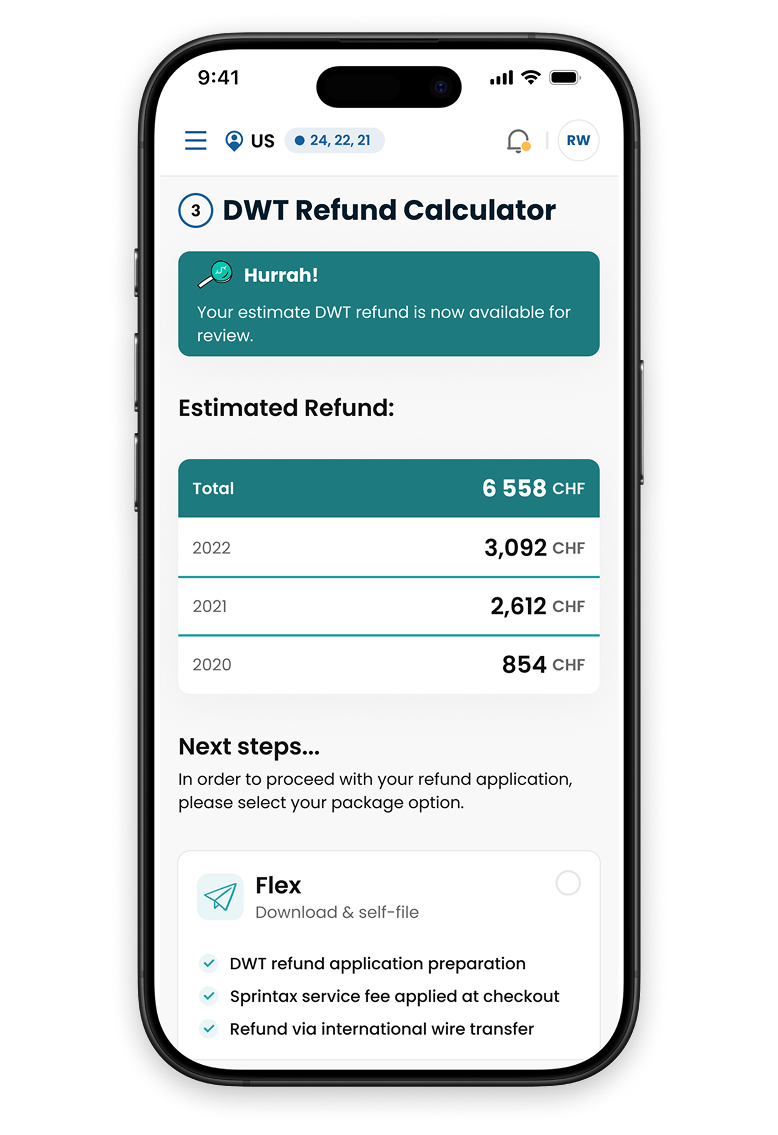

We’ll run the numbers

Our software will determine your tax treaty eligibility and provide an estimated refund for each tax year.

04

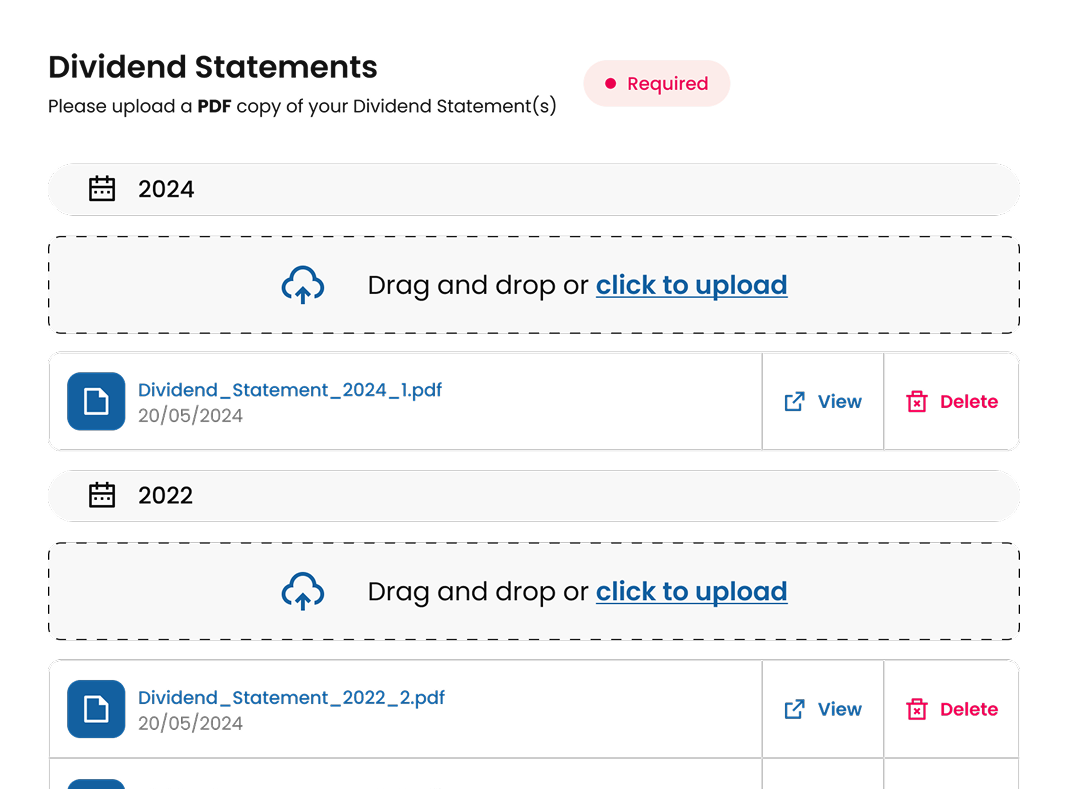

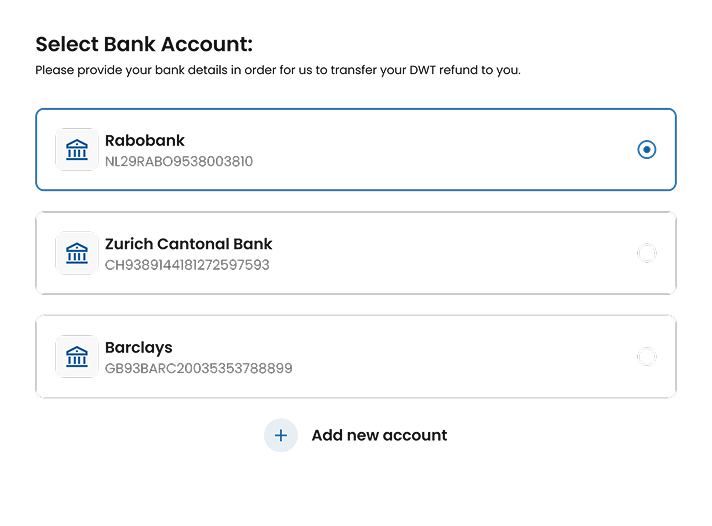

Upload your documents

Upload your dividend statement and certificate of tax residency, if required.

05

Claim your refund

Once your refund application is prepared, you can decide to self-file or have us manage it for you.

Who does Sprintax Dividends support?

Employee Stock Ownership Plan (ESOP) Participants

Individual Investors

Endowment Funds

Private Equity Firms

Organizational Investors

Transfer Agent / Custody Services

Why choose Sprintax Dividends?

We make it super simple

No complicated tax paperwork, just 5 easy steps to claim your DWT refund.

Expert tax support

Our team of tax professionals manages your application and is available to answer any questions.

Trusted by names you know

We collaborate with companies across the US and Europe to help ESOP members reclaim DWT.

Transparent pricing

We charge a flat fee for our service—no hidden costs, no surprises!

Partner with Sprintax Dividends

Managing cross-border ESOPs at your organization? Book a call with our partnerships team to learn more about how Sprintax Dividends can help.

Book a callSave time for your team

Outsource your tax queries to Sprintax. Our team will be happy to answer your employees questions relating to foreign dividend withholding tax reclaim.

Dedicated partner portal

Tailor your Sprintax Dividends partner portal to your organization’s unique specifications, with custom branding, email communications, and flexible pricing options.

Expert support

We provide a range of support materials including live chat, Q&A webinars, help guides, email support & more.

Because the more you know...

Your questions, answered

Dividend Withholding Tax (DWT) is a tax deducted at source from dividend payments before they reach investors. The rate varies by country, but many countries have tax treaties allowing nonresidents to reclaim part of the withheld tax. Investors—including individuals, ESOP holders, and institutions—can apply for a refund by filing a claim with the relevant tax authority.

Sprintax Dividends simplifies the process of reclaiming Dividend Withholding Tax (DWT) for organizations and individual investors. Our easy-to-use software removes the hassle of dealing with foreign tax authorities—no paperwork, no complicated processes. In just a few simple steps, you can reclaim overpaid tax on overseas investments and maximize your returns with ease.

Yes! Sprintax Dividends is designed to handle cross-border Dividend Withholding Tax (DWT) reclaims for investors with dividends from multiple countries. Our software simplifies the process by automatically identifying the tax treaties and reclaim opportunities available to you, ensuring you can claim your maximum refund.

The timeframe for processing your refund depends on the paperwork required and the processing timelines in each jurisdiction. While some tax authorities may process reclaims faster than others, we generally receive refunds within 6-8 weeks. However, in certain cases, it may take longer depending on the country and specific tax office handling your request.

The lookback period for reclaiming Dividend Withholding Tax (DWT) varies depending on the country where your securities are held. Each jurisdiction has its own statute of limitations for filing refund claims.

For example, in Switzerland, you can reclaim up to 4 years’ worth of DWT refunds, as the statute of limitations includes the current calendar year plus the three prior years. Other countries may have shorter or longer lookback periods, so it’s important to check the specific rules for each jurisdiction.