Calculate U.S. tax withholding for nonresident workers

Automate tax rate calculations, apply tax treaties, determine residency status, and generate payroll forms with Sprintax Calculus, all on a single dashboard

How does Sprintax Calculus help?

The documenting and withholding on payments to nonresident employees has become an increasingly important function for U.S. organizations. With this in mind, we have developed Sprintax Calculus to help payroll departments to easily manage the tax profiles of their nonresident employees on a single, user-friendly dashboard.

Sprintax Calculus ensures organizations with international employees or foreign vendors remain compliant with IRS regulations.

Tax compliance, simplified

01

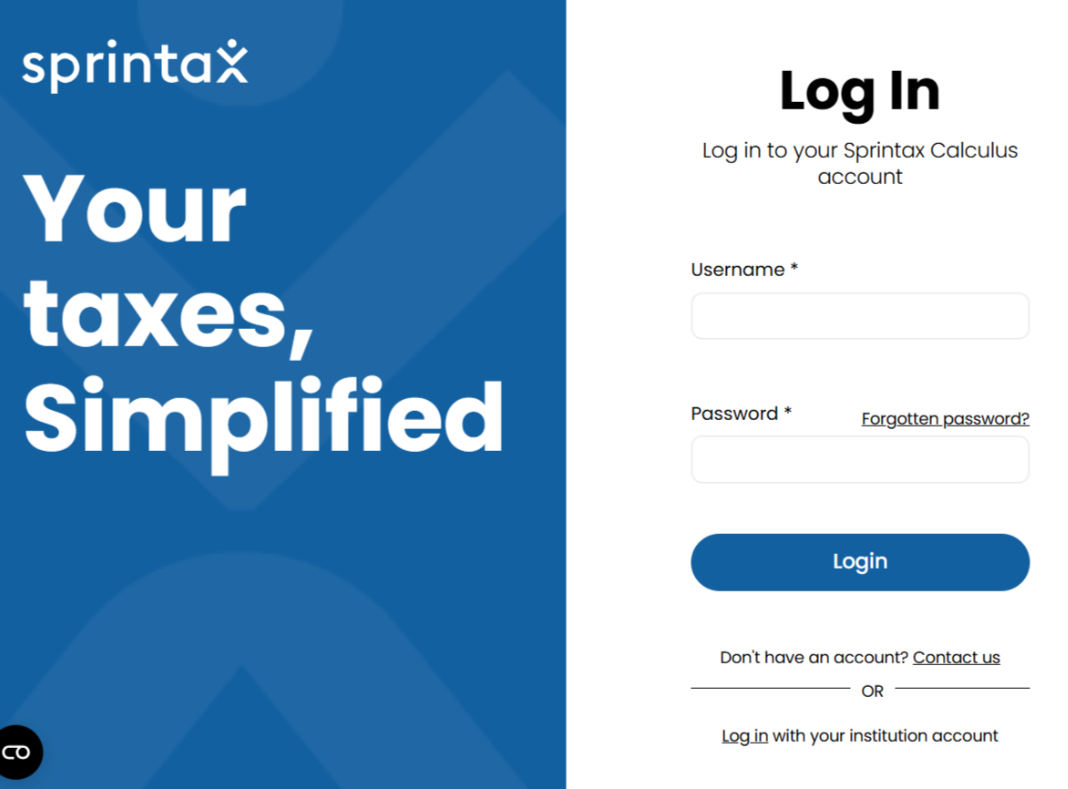

Create your institutional account

Chat with our team to set up your custom Sprintax Calculus account, complete with your institution’s branding and any required data fields.

02

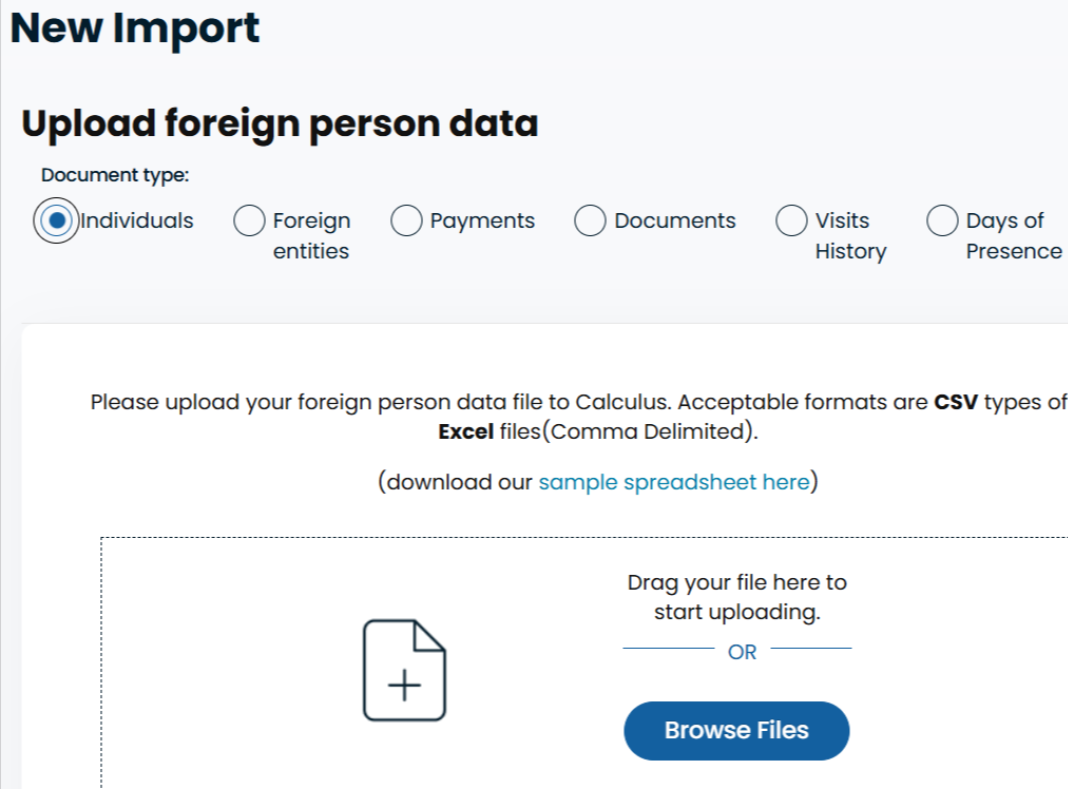

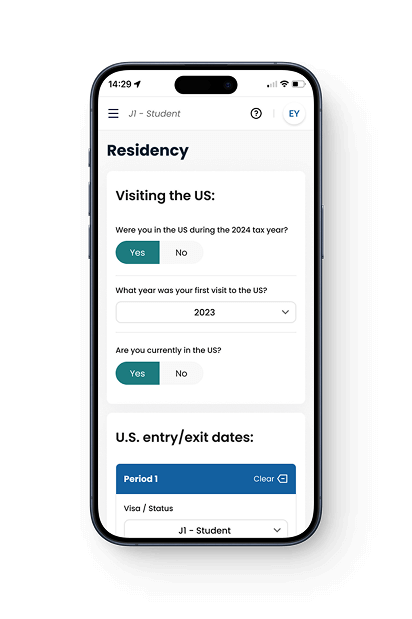

Add your nonresident population

Invite your nonresident population via email to create a profile or upload their data in bulk to the platform.

03

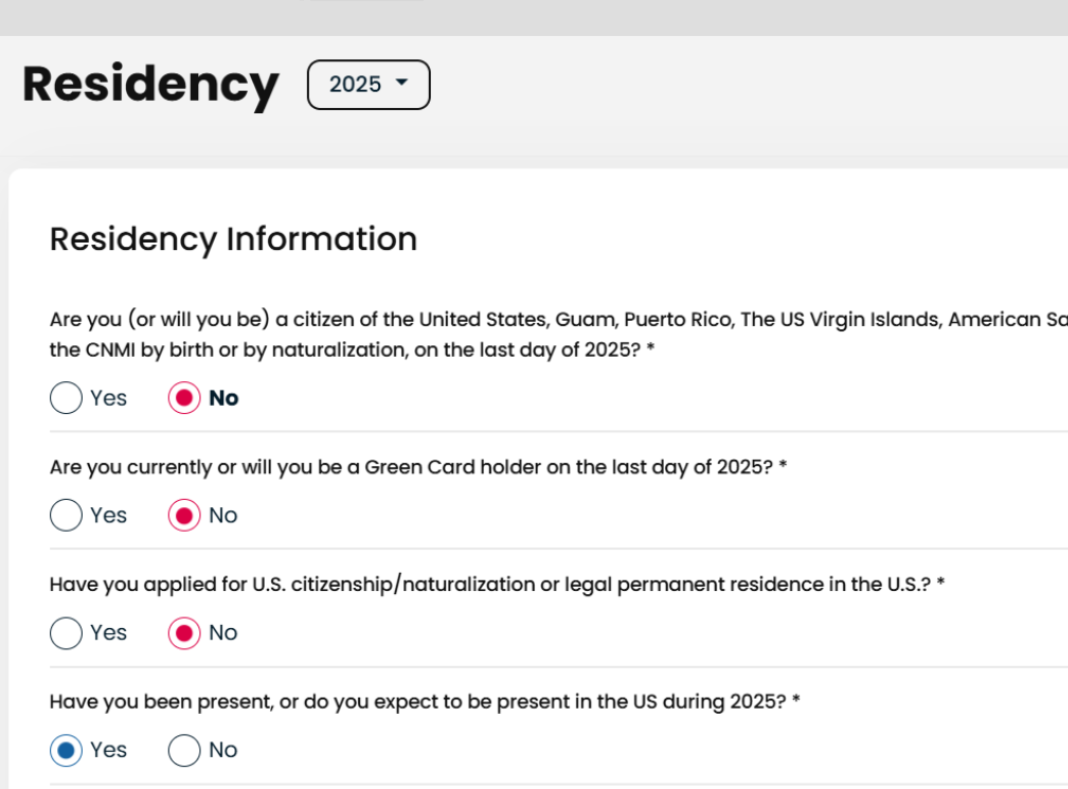

Tax profile determination

The system automatically determines each individual’s tax residency status, applies relevant tax treaty benefits, and calculates accurate withholding rates.

04

Generate required tax forms

Instantly generate all necessary forms including W-4, 8233, W-8BEN, and others.

05

Monitor compliance in real time

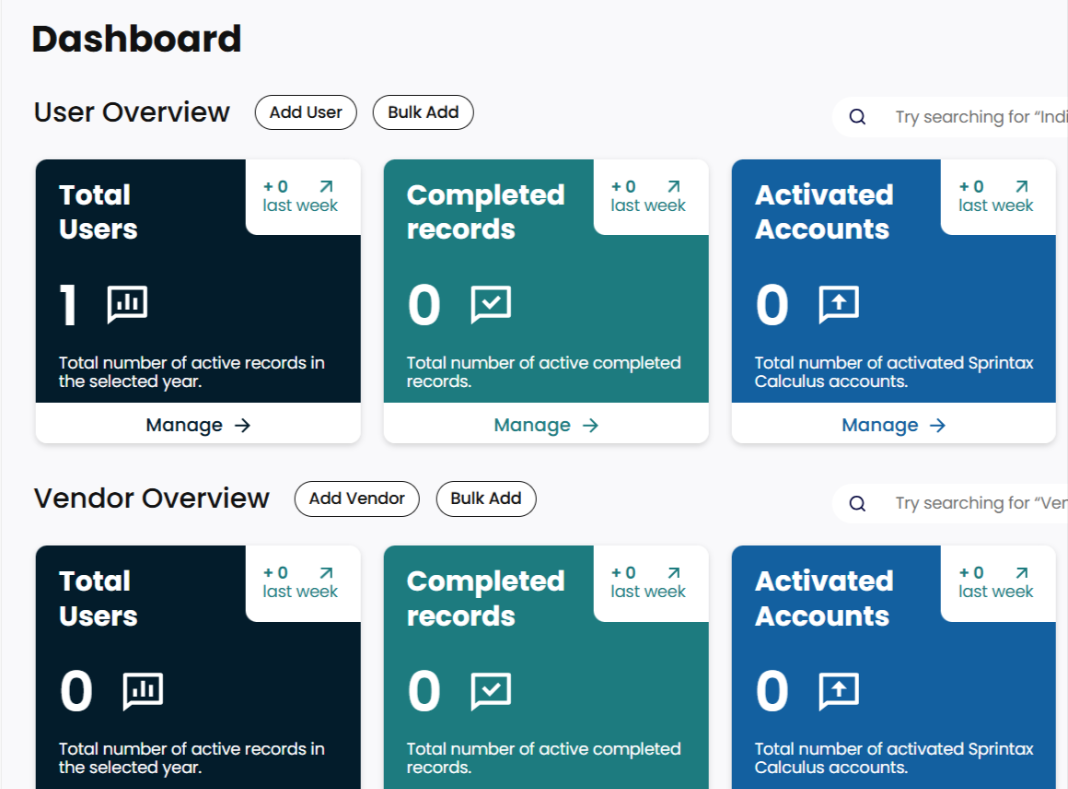

Use your admin dashboard to track compliance across your organization, with access to high-level summaries or detailed individual tax profiles.

Why choose Sprintax Calculus?

Tax residency determination

We’ll determine tax residency status and generate all required forms, including W-4, 8233, W-8BEN, and more for your nonresident employees.

Accurate tax withholding

With Sprintax Calculus, you can ensure your international employees are fully tax compliant in the U.S.

Trusted & secure

We are proud to be ISO 9001 and ISO 27001 certified as evidence of our commitment to upholding the highest standards in data security for our clients.

Expert support

We provide a range of support materials including live chat, Q&A webinars, help guides, email support & more.

Are you starting employment in the U.S.?

Starting work in the U.S. as a nonresident means completing important tax paperwork – but it doesn’t have to be stressful.

Sprintax Calculus (Forms) helps you quickly prepare these forms correctly so you pay the right amount of tax on your income and claim every tax treaty benefit available to you.

Take the guesswork out of tax compliance and focus on what matters most – enjoying your time in the U.S.

Learn moreWhat tax forms are prepared by Sprintax Calculus?

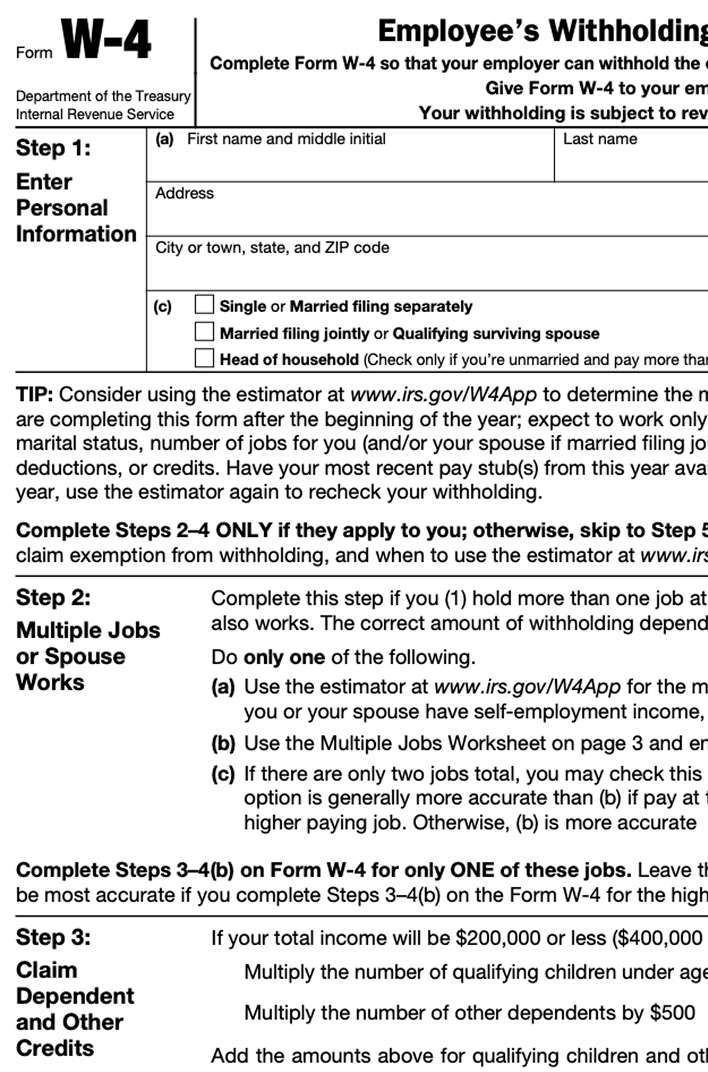

Form W-4

Every nonresident working in the U.S. must complete a W-4 when starting a new job. This form is used to determine exactly how much tax should be withheld from the nonresident’s paycheck.

Sprintax Calculus streamlines the process of accurately completing W-4 forms for each member of your nonresident population.

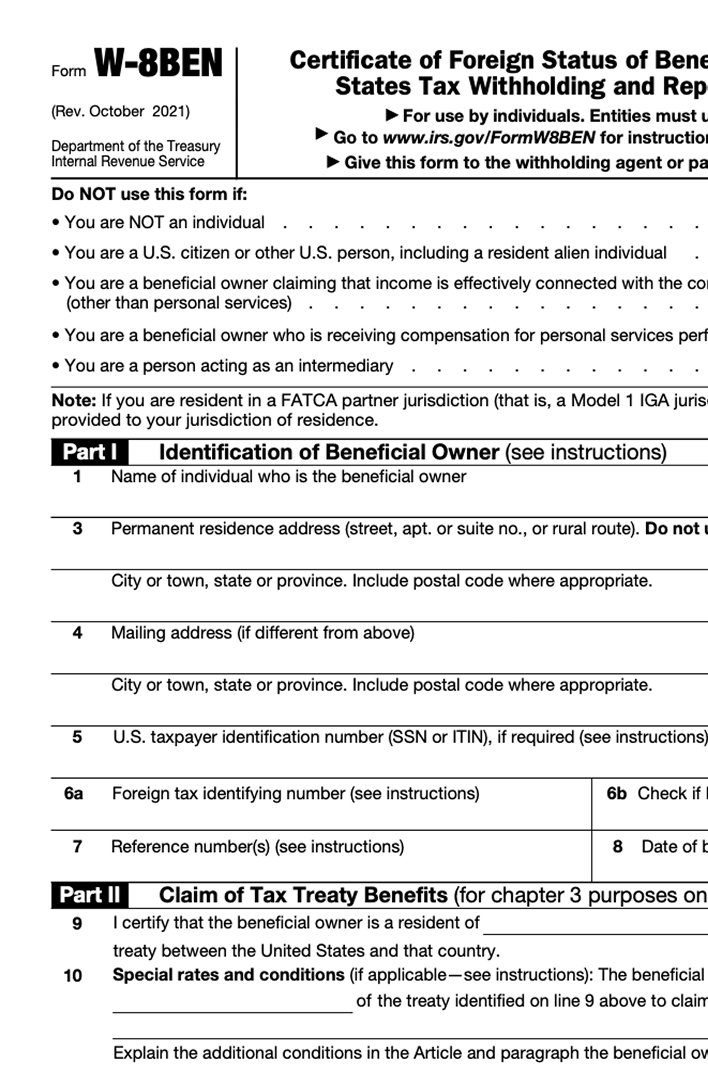

Form W-8BEN

Nonresidents can potentially reduce their tax liability by claiming tax treaty benefits. In order to avail of a treaty relief, nonresidents must complete a form W-8BEN.

Sprintax Calculus will outline the tax treaties available to your nonresidents and prepare Form W-8BEN as needed.

Form W-8BEN-E

By completing a Form W-8BEN-E (also known as a Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting), foreign vendors can claim a reduction in tax by availing of tax treaty benefits.

With Sprintax Calculus, Form W-8BEN-E for foreign vendors is created automatically.

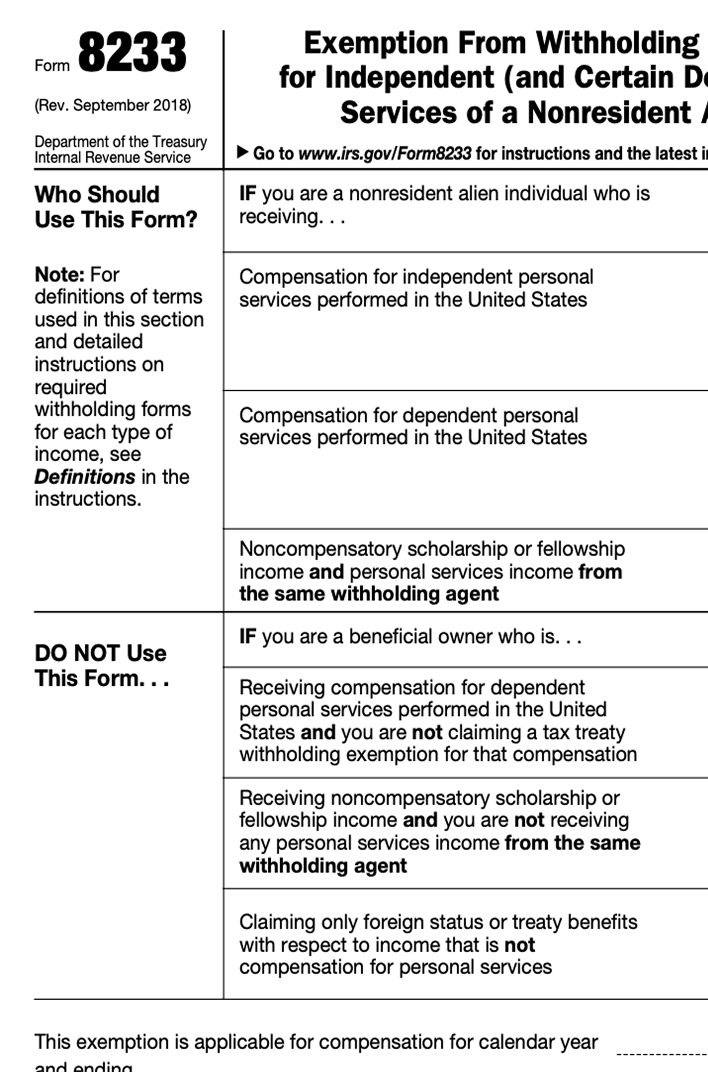

Form 8233

Every nonresident who earns a certain type of scholarship, personal services or fellowship income (including compensatory scholarship or fellowship income from the same withholding agent) is required to file a Form 8233. This form can also be used to claim exemption from withholding for certain personal services, because of an income tax treaty.

Sprintax Calculus helps your nonresidents prepare the tax documents they need – including Form 8233 – to remain compliant in the US.

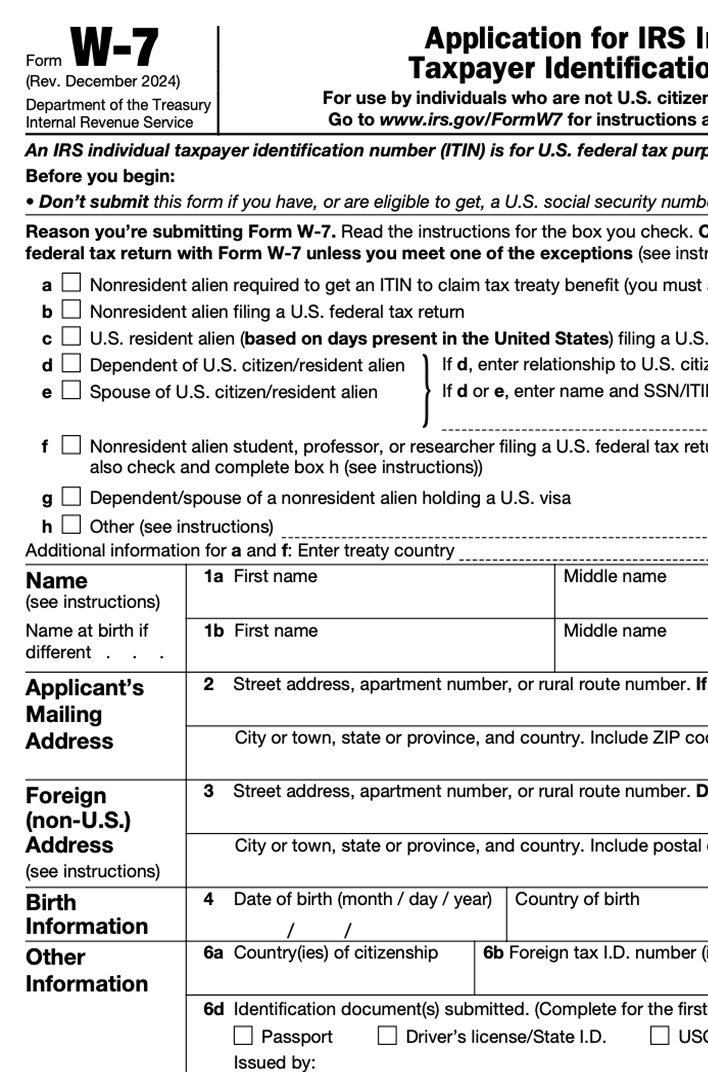

Form W-7

This form is used by nonresidents who are not eligible for a Social Security Number and need to apply for an Individual Taxpayer Identification Number (ITIN) to file a federal tax return. Where a nonresident requires an ITIN, Sprintax Calculus will quickly help them to complete their W-7.

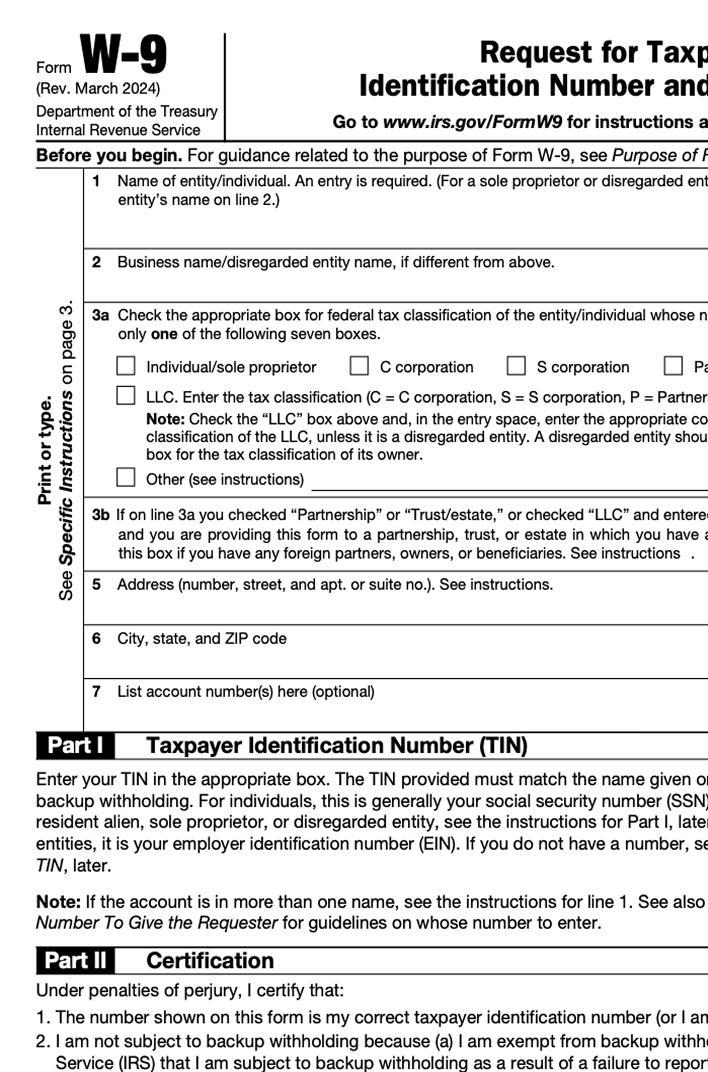

Form W-9

Form W-9 is used to provide and certify a Taxpayer Identification Number (TIN) and to verify that the nonresident is not subject to backup withholding.

Sprintax Calculus will support any member of your nonresident population who requires this document.

Form SS-5

Form SS-5 is the application used to request a U.S. Social Security Number (SSN) from the Social Security Administration (SSA). It’s also used to replace a lost or stolen Social Security card or to update information, such as a name change.

Sprintax Calculus will provide a completed Form SS-5 for any nonresident who requires a SSN.

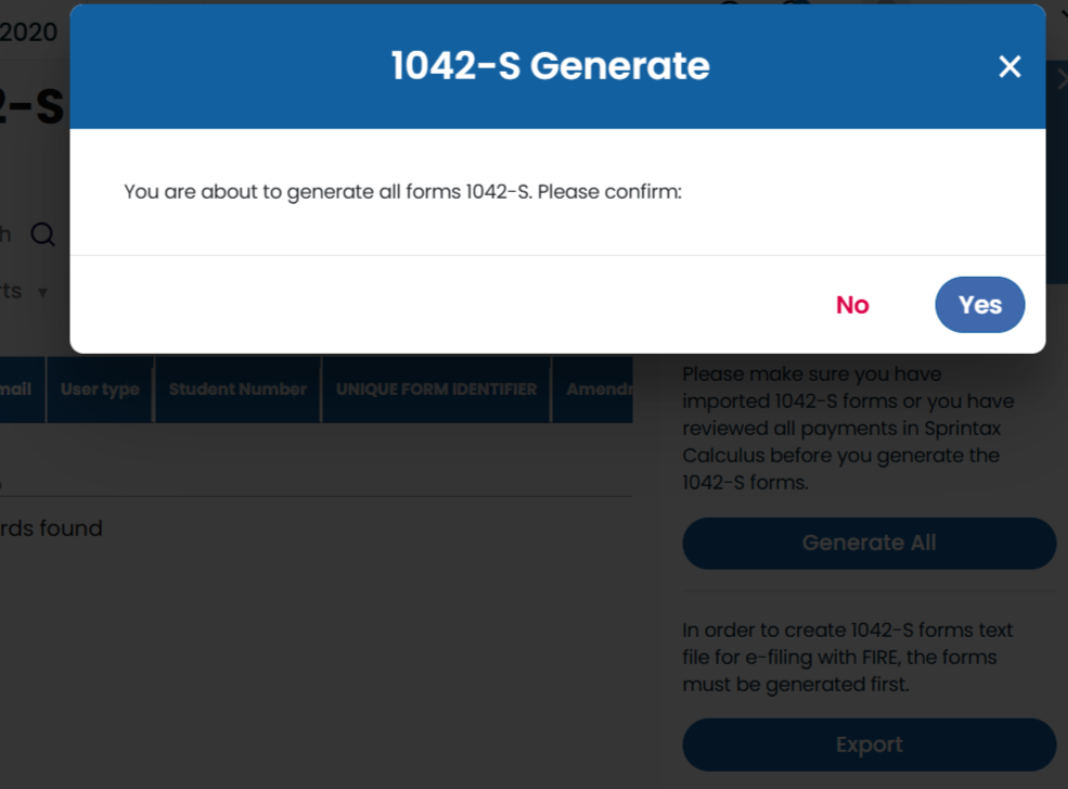

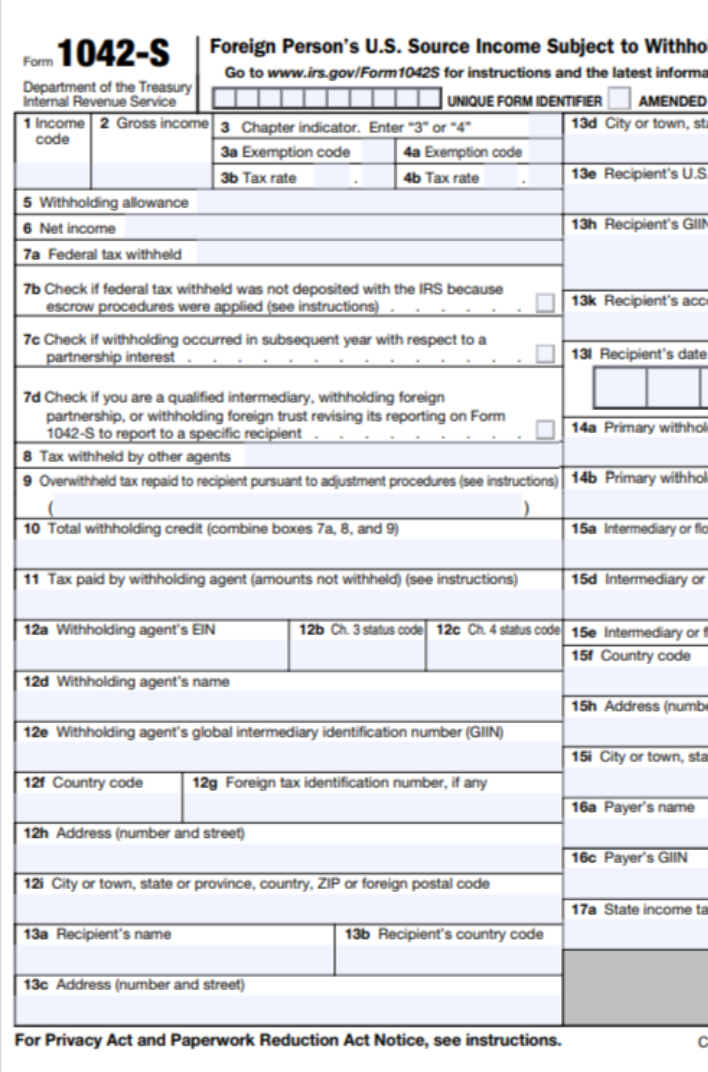

Form 1042-S

Form 1042-S is the official information return used to report U.S. source income paid to nonresidents and other foreign persons. Issued by the withholding agent to both the payee and the IRS, it covers income exempt under a tax treaty (such as wages, scholarships, and fellowships), independent personal services income, royalties, awards, prizes, gambling winnings, and deposit interest. The form must be provided to recipients by March 15 of the year following payment.

Partner with Sprintax Calculus

Managing nonresident tax withholding and payroll at your school or organization? Book a call with our partnerships team and discover how Sprintax Calculus can help.

Book a callAccurate tax withholding calculations

Our system calculates nonresident tax withholding and determines whether they are eligible for any tax treaties or deductions.

Integrate with leading payroll softwares

We’ve built a powerful ecosystem with nonresident tax determination, withholding and payroll, seamlessly integrated via our open API.

Real-time reporting and admin dashboard

Access real-time reports through our cloud-based platform. Leverage high-level dashboards or drill down into individual tax profiles.

What our partners say?

Sprintax has been a welcome addition to the processing of our Institutions Non-Resident Alien (NRA) employees. The cloud-based software is user-friendly, and the knowledgeable support staff is quick to answer any questions you might have. NRA employees are able to submit all of their information and supporting documents for verification and Tax Treaty determination online. At year-end they are able to access their 1042S Forms via their online account and use TDS Sprintax to file their annual tax return if desired. Program views can be tailored to your needs and reports can be easily extracted for analysis and verification. Overall, Sprintax has proven to be an effective way to efficiently maintain our NRA employee files in a cost-effective manner.

Your questions, answered

Sprintax Calculus is a dynamic, dependable system built specifically to help organizations manage tax withholding for their international employees.

With Sprintax Calculus, your payroll team can easily oversee nonresident employee tax profiles, all in one place through a user-friendly dashboard.

Today, over 700 organizations across the U.S. trust Sprintax Calculus to help them manage the taxation of their nonresident employees.

Sprintax Calculus prepares all the documents your payroll office needs to manage nonresident taxation. Our system provides foreign nationals with required tax forms, including W-4, W-8BEN, and 8233. 1042-S forms are automatically generated and converted to PDF for easy distribution.

Additionally, Sprintax Calculus can prepare SS-5 or W-7 forms upon request.

Yes! Sprintax Calculus handles all aspects of tax treaty determination for you.

You don’t need to be familiar with complex tax treaties or regulations – our system includes every applicable treaty and automates the process.

Sprintax Calculus clearly outlines who is entitled to a tax treaty, what that entitlement means for the employee, and the impact it has on you as the employer. Everything you need to manage tax treaty benefits is built directly into the platform.

Sprintax Calculus frees up valuable time and resources for your payroll and international office teams. Our system ensures the correct amount of tax is withheld from nonresident employees and accurately reported to the IRS.

At the same time, foreign employees are guided in determining their tax residency status and eligibility for tax treaty benefits, ensuring they are taxed correctly from their first paycheck.

Plus, with open API integration, your transition to Sprintax Calculus is seamless, allowing smooth, two-way data transfer between your payroll software and our system.

Nope! Sprintax Calculus is a cloud-based platform – no software installation required. Simply log in to your account anytime, from anywhere.

Why not register for a free, no-obligation demo of Sprintax Calculus?

Our team will be happy to walk you through the system and answer any questions you have.

Sprintax Forms was originally launched to help nonresidents in the U.S. ensure they pay the correct amount of tax on their income and claim any tax treaty benefits they are entitled to.

Sprintax Calculus, on the other hand, was developed to help U.S. organizations navigate nonresident tax withholding efficiently.

Today, Sprintax Forms has been fully incorporated into Sprintax Calculus, combining both functionalities into a single, streamlined solution.

Ready to get started?

Discover how Sprintax can support your organization with nonresident employee payroll and foreign vendors

Chat to the team